Ladies and gentlemen, welcome to the 165th Pari Passu Newsletter.

I hope you are enjoying a wonderful Christmas, and this is the only email you are receiving today. Today, we will have a very relaxing and enjoyable Pari Passu edition, our third yearly letter.

From being used as a source of the Apollo-Altice coop lawsuit, to being read by some of the most senior Wall Street investors, this year has surpassed any expectations, and I am extremely grateful and excited for the future. Let’s dive into some of the behind-the-scenes, our best write-ups of the year, and fun moments.

9fin x Pari Passu | Winning Duo

As part of our multi-year partnership, 9fin purchased this ad slot, but was kind enough to let me take pen, so we do not break the flow of our annual letter.

Let me give you more context on our businesses and explain what we are doing together. You can call Pari Passu a media business, a newsletter, a research service, or any other declination of it, but fundamentally, our model boils down to creating written content. Revenue is generated through two primary ways: money readers give us to read our premium content (subscriptions) and money companies give us to reach our audience (ads). Fundamentally, this is virtually how all media businesses operate.

Since a core part of our mission is to make institutional-level restructuring research more accessible (we charge 60% less than our closest peer), my philosophy has always been to charge as little as possible. Specifically, I aim to cover our costs through subscriptions and use sponsors to generate profits.

In terms of how ads are structured, the vast majority of companies will think on a CPM basis (how much does it cost to reach 1,000 readers), but the truth is that our reader base is grossly skewed towards a small and unique set of professionals. Therefore, a classic CPM calculation grossly undervalues our potential. In addition, we are also well aware that bad ads worsen the reader experience, so we always try to be very selective with whom to work.

That selectivity is why we chose to work with 9fin.

They’ve been an excellent sponsor of the Pari Passu community, supporting us commercially and participating actively, including sending two senior restructuring analysts to judge our inaugural Pari Passu Restructuring Competition (on a Saturday afternoon).

Beyond sponsorship, 9fin has also been genuinely helpful in improving and accelerating our research:

We have full access to their platform, which makes it easier to work through complex situations without missing material details.

The company overview consolidates news flow, ratings actions, court documents, timelines, cap tables, and proprietary analysis in one place, which has materially reduced friction during our research process and helped ensure we were capturing everything relevant.

When we get stuck on technical points, we’re also able to speak directly with their analysts.

In addition, 9fin has extended tangible benefits to Pari Passu readers, including access to selected webinars and educational content that would normally be reserved for enterprise customers (such as the LME crash course), as well as a curated list of free resources.

Finally, 9fin is offering Pari Passu qualified readers a 45-day free trial of their platform — 15 days longer than the standard trial — for those who want to explore it themselves.

In summary, they are truly generous with their time and resources, and I hope you are getting value out of it. If your firm is looking to stay ahead, I encourage you to trial their debt-intelligence platform.

Our Elevator Pitch

If you are new to Pari Passu and want to learn more about our history, you can find here the Year 1 Letter, and Year 2 Letter. As a 30-second summary, I (Rx) started the newsletter when I was a restructuring investment banking analyst, as I was not happy with the restructuring resources out there. Over time, I had realized there was a gap in the institutional-grade restructuring research market. And I decided, eventually, that I would be the one to fill it.

Three years and 165 editions later, we are now a small team providing restructuring-focused research.

Pari Passu by the Numbers and Some Philosophy

So, how did we do this year?

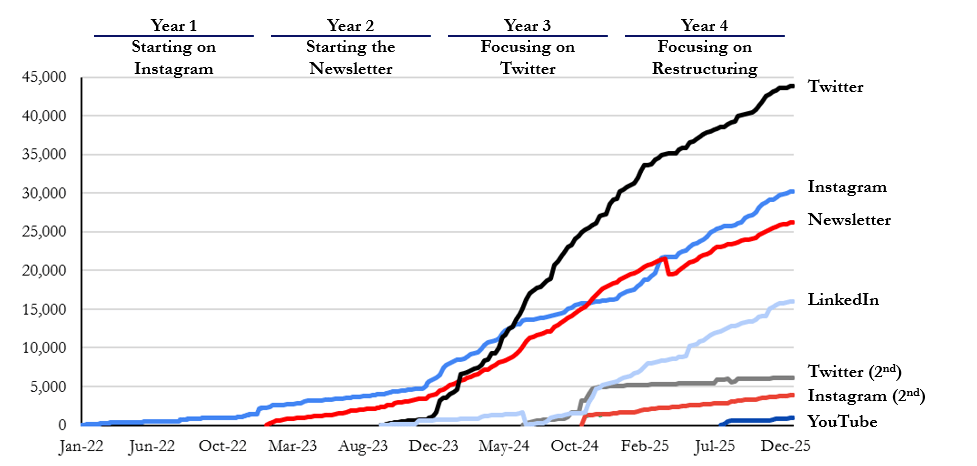

At my core, I am an analyst, and I love numbers, so let’s start from the image below, where you can find a detailed performance of our different channels since 2022.

As expected, growth slowed significantly this year. While this is frustrating, this was expected. As I am going to explain in more detail later, this year we decided to focus our efforts only on restructuring. As a result, the total market is significantly smaller, and so will be our growth. While getting used to lower growth is never easy, I am convinced this is the right choice.

After all, what is the point of more readers? More money. And what is the point of more money? Doing what you want. What do we want to do? Restructuring focused research, so we might as well stick to it in the first place.

Image 1: Channel performance since inception

As I reflect on our journey, one sentence stands out: “It might look too late, but it always is early.” From my heights of 30 years of age or so, I am slowly realizing that every time I thought “It is too late, no point in doing this now,” I was dead wrong. Dead wrong. Try remembering any time over the last few years when you had this thought, looking backwards, was it too late?

No, it never is. I know, because I fell victim to this so many times. Hell, I almost did not start the page and the newsletter because “It is too late, there are too many pages and newsletters”. Looking back, it was so early, and it still is. Everyone will tell you the market is too saturated, but that’s not true. I truly believe there is always room for great work.

Do you not believe me? Here is a simple idea for one of you to do. There is no great sector-specific investing newsletter. And I mean, great newsletter, not some mediocre work with 15 links and one takeaway that takes 45 min to write.

I can think of so many variations, a consumer / TMT / industrials / etc., there is so much whitespace just in this area of the market, and anyone can do it. Remember, everything starts as a guy or girl with a laptop; the rest is up to you.

So here it is, the idea is yours. Go do it.

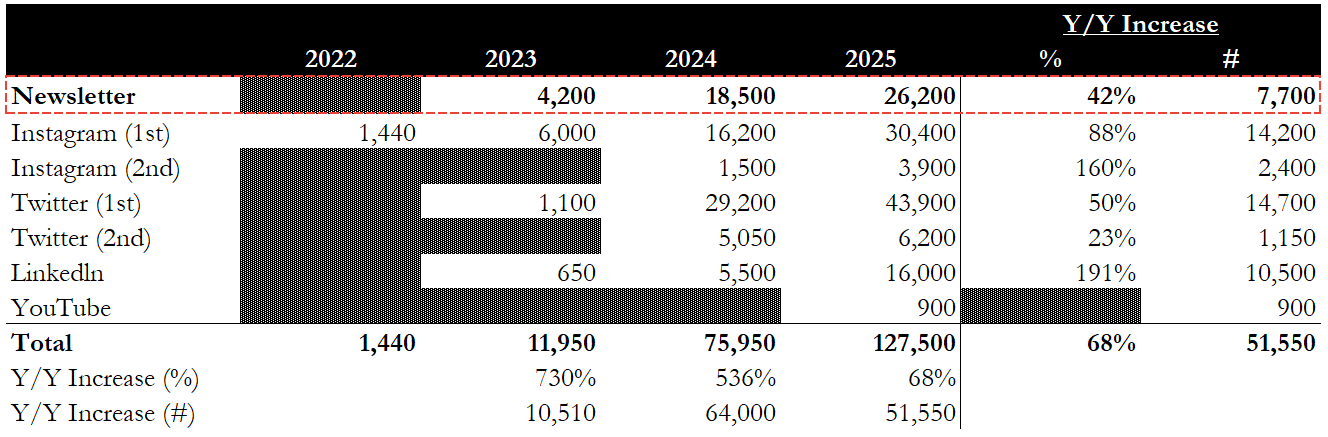

To close off this section, you can see below a snapshot of the Pari Passu ecosystem. To be honest, I do not look at the numbers as much as I used to. It is nice to know that our community is growing, but all we care about is delivering superior restructuring research. Followers and the number of subscribers are like money; you should not focus on them.

Focus on quality and let time take care of the rest.

Image 2: Channel performance since inception (detail)

Our focus on Pari Passu Premium was a core development of the year, so it is right to give you more context about our logic and vision for the platform.

When I launched Pari Passu in January 2022, the idea was to create more in-depth content that I could not post on Instagram, but nothing as technical as the write-ups we are publishing today. I was a banking analyst working classic long-hour weeks, and the newsletter articles were the result of me pulling something together, usually on Saturday.

After one year, I realized that if we wanted to do things more seriously, I had to hire for help. In January 2024, I started to work together with a talented analyst who helped me with research, analysis, and writing. This was also after I transferred from banking to the buy-side, so I had a much more stable schedule and was able to dedicate more hours to writing.

Over the year, we made huge progress, and we started publishing some editions that made us famous (e.g., Synethik PIK, Triple Dip, Double Dip Pari Plus). To this date, many of these editions are the only source of comprehensive coverage on these topics. You can test this by googling “what is a triple dip?”

In December 2024, we made an important decision: Focus exclusively on restructuring (no more company deep dives, finance-adjacent trash) and really start to think of ourselves as a leader in restructuring research. We expanded the team, and the time spent on each write-up increased 10x from what I was doing alone in 2023.

If before I would publish ~1,000-word simple write-ups I pulled together in a day, now we have started publishing 5,000+ word write-ups that take 50+ hours of research (including primary research, talking with investors/bankers/lawyers involved in the transactions), multiple revisions, and many back and forth to perfect the content and ensure accuracy.

You loved it, people started really appreciating the research and asking for more. This encouraged me to further double down on the newsletter.

Therefore, in April 2025, we started publishing our Premium content, where we perfected our core insight behind Pari Passu: Provide comprehensive, technical coverage of the most consequential restructuring transactions.

Whereas some providers focus on surface-level transaction summaries only, others provide multiple, disjoint updates that are hard to follow. We aim to publish research that covers the situation (a) in more depth than anyone else and (b) with greater technical complexity than anyone else (I am, after all, just a restructuring banker at heart)- all within one, structured article.

These premium write-ups became our most read pieces of the year, and this type of premium research will be our focus going forward. While we will still provide plenty of free research, the highest value research will be behind a very accessible paywall. This type of content is very valuable to a small number of people; therefore an ad-based model will never enable us to keep growing and scale the team.

If we keep executing, we hope to have more subscribers at a higher price point, grow the team, and provide more research with the same level of quality.

As a reminder, upgrading today will lock the price in perpetuity. If upgraded when we started our premium offering in the summer of 2023, you would be paying $70/year as opposed to $400/year. Join us and unlock all past and future research.

Review of Plan for 2025

Like we do every year, we will start by reviewing the goals I set at the end of last year. Let’s see how we did.

Goal (1) “More Restructuring Content: I have historically had the line of thought that content should be what I am interested in. I am not trying to look selfish but I need to be interested in what we put out, or things will quickly stop working. Therefore, content has generally followed my main job. When I started the newsletter, I was a restructuring analyst, and therefore content was 100% restructuring-focused. Then, I transitioned to the buy-side and I had a bit of an identity crisis and started to expand to company deep dives because I felt I had to. My thinking was something along the lines of “That is what I do in the main job, therefore I should change what I write about.” Over this last year, I realized that the writeups I was really excited about were all restructuring-focused, and this is what makes Pari Passu different. The world does not really need another deep-dives newsletter. While I plan to occasionally publish deep dives, I want to make restructuring the focus of Pari Passu again.”

Review: In hindsight, this was obviously the right reason, and I am extremely grateful we did. The newsletter should not follow my career path, and this was a limited mindset I was operating under due to a lack of experience. Therefore, from January, we went back to our roots and started covering again, only restructuring topics. As mentioned above, this led to a slower growth (as the pool of readers is smaller than before), but this is not what we are maximizing for. Our goal is to provide the best restructuring-focused research, and this is all we should be focusing on.

Goal (2) “Keep Pushing Twitter and LinkedIn: 2024 was a great year as I learned a lot more about these two platforms and I am excited about the future of these channels. My thesis is that memes are overvalued and advanced educational content is undervalued, and I intend to

provide liquidityfill this gap.”Review: I won’t spend a lot of time here. I progressively see social media just as a medium to grow the newsletter. Newsletters are very hard to grow organically. Think about it, how many times this year have you sent a newsletter to your friends? How many times did you send them a social media post?

In summary, I will, of course, keep doing social media, but our brain cells will be focused on the newsletter.

Goal (3) “Think of Business Ideas: Sometimes I love wondering what the Pari Passu Ecosystem will look like in the 2030s. While I have no clue, I do know that if it is just a media business, I will be disappointed in myself. I do not have an on/off goal for this year, but I want to encourage myself to keep my eyes open and start thinking of businesses to build around Pari Passu.”

Review: I might have changed my mind here, or at least, I am not sure anymore. Right now, I want to stay focused on what we are doing as things are great and trending in the right direction.

On this same line of thought, I do not have particular plans for 2026 that I would like to share. I just want us to stay focused on delivering some really great restructuring research. Greatness comes from doing the same thing over and over for many years and letting the power of compounding show its force. This is our plan.

2025 Pari Passu Highlights

To recap this great year, I would like to revisit my favorite write-up of each month:

January - Red Lobster (watch on YouTube): It is always fun to cover consumer names that everyone knows, as this opens your eyes to so many interesting things. I encourage you to revisit this write-up, as it incorporates many exciting topics like predatory private equity, credit bidding, in-court litigation, and, of course, shrimp.

February - Neiman Marcus: A true restructuring classic, from some hot-potato PE and a contentious drop-down LME, to a COVID-driven luxury retail bankruptcy, and criminal-bid-rigging charges, the drama of Neiman’s restructuring is unmatched, a must-read!

March - Talen: In times when everyone has become a power investor, this write-up is very fitting. The company went from a publicly traded power producer to a privately held entity, then into Chapter 11 bankruptcy, and has been almost a 10-bagger since its emergence!

April - Air Pros: HVAC roll-ups are everyone's favorite business, so when one went into Chapter 11, we had to dig down. This serves as a great introduction to how (not to) execute a successful roll-up in any sector.

May - Graftech: Here, we provided a detailed full credit document analysis to understand the terms that governed its restructuring transaction. Spending time calculating baskets is not what we usually do, so it was very fun to write and was well-received.

June - Hunter-Gatherer: This write-up really marked a step-up in our content. We do not rigorously track the hours spent on each write-up, but I think this marked the first write-up that took over 100 hours of work. The result was worth the work; we heard law firms in London shared internally, and something else that I cannot mention happened because of this write-up (exciting things ahead).

July - Saks: Historically, we stayed away from very quickly evolving situations, but here, we had to make an exception. Saks was everything everyone was talking about (hard not to!), and we wanted to fill the lack of coverage. We worked around the clock to publish in record time, and you loved it.

August - Quest (available for purchase here): As summarized by the Apollo short on the sector, PE-backed software was another theme of 2025. This write-up provides a detailed overview of the Clearlake portco, its corporate history, strategic pivot, and of course, the in uptier transactions and liability management before diving deep into the details of Quest’s May and August 2025 uptiers

September - Better Health (available for purchase here): A true LME classic that you must understand. What I loved about this write-up is how simply we tried to distill the transaction structure. Restructuring professionals (really all professionals) use complex terms; we are doing our best to break things down to first principles.

October - Thames Water: My philosophy has always been to write a very comprehensive write-up for each situation, so when we started discussing the idea of a multi-part deep dive, I was skeptical. After learning more, we realized there was just too much to explain, and this ended up being a three-part write-up for a total of almost 20,000 words. Hundreds of hours, discussions with lawyers, and primary resources went into this write-up, and the result was very special.

November - Oregon Tool (available for purchase here): This write-up marked the first time we heavily relied on a source to provide us with much of the private information that makes these LMEs so hard to truly understand.

December - Century Brew: I like to think the last write-up of the year was one, if not the best of the year. After talking with multiple parties involved, we were able to provide a very detailed overview of the 2024 LME (dropdown + double DIP), the 2025 bridge financing, the 2025 LME, and so much more. It took us three years to have the infrastructure to cover private LME, and we are finally there!

On this point, if you are interested in becoming a source for our proprietary research, please fill out this form. If you work in credit or restructuring, would love to contribute, and earn a Pari Passu Premium subscription, fill this form.

Fun Behind the Scenes

Enough restructuring, let’s move to the fun stuff. These are the most salient Pari Passu-related events of the year.

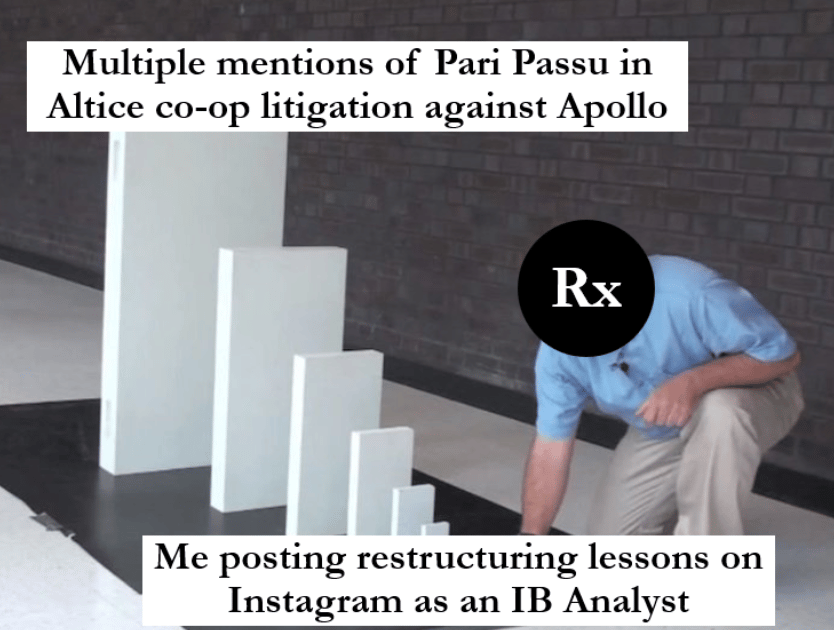

The Apollo Co-op Lawsuit

As I am sure you are very well aware, last month, Altice sued Apollo and other lenders on antitrust grounds. What you might have missed is that Pari Passu was used multiple times as a source! Needless to say, I could not believe it. I used to make Instagram posts covering Moyer, and here we are just three years later. I started the Instagram Page and the Newsletter because I wanted to share with everyone how cool restructuring is, and this is getting out of hand, but in a good way. This, right here, is the power of compounding.

Image 3: Pari Passu Chain of Events

Our New Website

In addition to working very hard to elevate our content, this year we invested in improving the overall customer experience of our research. In particular, we did a website makeover that I am particularly proud of. In particular, we added two highly requested functionalities:

Dynamic Archive: You can finally sort through our ample archive by type of article, type of restructuring, industry, and sponsor involved.

Group Subscriptions: We now allow group subscriptions and signed the first few group subscriptions with investment firms. If your team is interested in bulk discounts, please reach out ([email protected]).

If there are some features that you would like us to implement, please reach out. I would really love to hear your opinion.

The Restructuring Competition

This year, we launched the first Pari Passu Restructuring Case Competition. For years, college students have had access to dozens of stock pitch competitions, but no nationwide competition focused on restructuring has existed. This is why we are launching the Pari Passu Restructuring Competition, which is open to any undergraduate student at any accredited university in the world.

It ended up being an amazing success with hundreds of applications, and we look forward to repeating next year. On this page, you can find the deck of the winning team, and you can register to be notified as soon as the 2026 competition kicks off!

Conclusion

I said it in our first year, I said it last year, and I will say it again. I feel extremely grateful to get the chance to do this. I get to spend my time doing something that makes me so excited to be alive. It is genuinely an amazing feeling, and I really wish you will find it. It does not mean you need to quit your job and start a venture-backed startup, maybe it just means you need to start a small business you love and let it compound for a few years :)

To close off the year, I would like to say thank you to:

You: Needless to say, all of this would not exist if you did not read and engage with our content. So many of you are so kind and always share encouraging words, and I am truly grateful to whoever shares the newsletter with their colleagues and friends. When you guys tell me you share Pari Passu on networking calls with sophomores, my heart truly melts. After all, I used to be a sophomore too. If you made it through here, I would be so grateful if you could fill out our year-end survey. I read every single response, and we use it to keep improving!

Analysts: When I started, this was a one-man show. Over time, this has evolved into a small team, and this has been an incredibly rewarding and exciting development. I used to think I did not like teaching, and I actually realized I love teaching, I just want to teach to really brilliant people. Working with brilliant analysts like you is truly one of, if not the best part of this job. I sincerely thank you for your work and want you to know I do not take the responsibility to develop and teach you lightly. Seeing you grow and improve is truly one of my biggest satisfactions, and I genuinely believe you would run circles around any distressed debt reporter out there. **

We will be back in 2026 with some electric write-ups. Pari Passu's future is bright, and we are excited to share it with all of you!

Our inbox is open, we would love to hear from you with any thoughts.

Best,

Rx

** We are expanding the team and will start to have permanent full-time analysts positions. If you have restructuring or credit experience, our evergreen job posting is here.