Welcome to the 95th Pari Passu Newsletter,

Over the past few weeks, we have spent some time learning about liability management transactions - specifically the iterations of double-dips and triple-dips. Today, we are going to look at another variation of the double-dip: the pari-plus transaction by analyzing the fascinating restructuring of Trinseo.

This is a complex and interesting variation that incorporated an asset dropdown as well as a double dip in their out-of-court restructuring, but no reason to be intimidated. We are going to explain this in plain English so that everyone can appreciate the complexity of restructuring that we all love. Let’s get to it.

Hebbia works with lean leading credit and restructuring shops.

Hebbia can summarize a credit agreement, draft one-pagers based on your team’s investment philosophy and so much more.

Book a 20 minute demo to see why they work with 1/3 of the 25 largest alternative asset managers.

Trinseo Deep Dive

Over the past few weeks, we have spent some time learning about liability management transactions - specifically the iterations of double-dips and triple-dips. Today, we are going to look at another variation of the double-dip: the pari-plus transaction in the case of Trinseo. This is a complex variation that incorporated an asset dropdown as well as a double dip in their out-of-court restructuring, but we are going to simplify this transaction to the fundamentals surrounding it.

What is a Pari Plus Transaction?

Before diving into Trinseo, it is essential to understand the differences between a pari-plus and double-dip transaction. Recalling our double-dip paper, there are 3 components to a double-dip transaction, and this can be seen in Figure 1 below.

An entity lends money to an empty box (the non-guarantor sub).

This box then transfers that money (in the form of an intercompany loan) to another box (the restricted sub or ParentCo) with pre-existing debt / assets.

The ParentCo then guarantees the initial loan (pari to pre-existing debt), creating a second secured claim for the double-dip creditor . This creates two claims from one initial loan, thereby resulting in a double-dip structure.

Figure 1: Illustrative Double-Dip Transaction Structure

The critical note regarding the double-dip transaction is how the ‘dips’ are treated. In Figure 1, notice how both claims are coming from ParentCo. These claims are considered ‘inside the credit box,’ meaning that ‘dips’ sit part of the debt already sitting inside the credit box (in this case, the debt existing at ParentCo). This is the stark contrast between a double-dip and a pari-plus structure.

In a pari-plus structure, the intercompany loan is still provided to ParentCo and sits as part of the debt existing at ParentCo. However, the new-money guarantee comes from entities outside the existing credit group. These entities will have substantial non-guarantor assets. All this is a way of saying that the assets held at the ‘outside entities’ level are not covering the existing debt at ParentCo. If ParentCo were to file, the intercompany claim would be treated with the existing ParentCo debt. In contrast, the guarantee claim would have its asset group to cover its claims, providing an enhanced structure. The best way to think about this concept is in terms of asset groups. As previously stated, companies have entities that hold the debt and are subject to the ‘credit box’ covenants, which tend to be very restrictive. Inside the credit box, the existing debt is secured by a majority of the company's assets. However, sometimes companies have excess assets that are not collateral for any of the existing debt. This is what the guarantee claim in a ‘pari-plus’ transaction is granted access to. By getting a secured claim, it has the first priority on that assets value in the case of a liquidation or sale. This can be seen below in Figure 2 [2].

Figure 2: Pari-Plus Transaction Structure

Trinseo Background

Trinseo, known initially as Stryon, was a part of the Dow Chemical Company until it was sold to private equity firm Bain Capital for $1.63bn in 2010, resulting in approximately $1.2bn in debt by the time Bain Capital exited its position via a 2014 IPO. Trinseo is a specialty material solutions provider. The company has business segments including Engineered Materials, Latex Binders, Plastic Solutions, Polystyrene, Feedstocks, and Americas Styrenics [7].

Engineered Materials: The engineered materials segment consists of thermoplastic compounds and blend products - both materials that can be remelted and reshaped, making them useful for various manufacturing processes such as molding. This segment does not suffer as much from seasonality due to the steady demand for various end-products, such as consumer technology, medical appliances, and footwear [7], [8].

Latex Binders: The latex binders segment produces styrene-butadiene latex, in which Trinseo and other latex polymers are the market leader. SB latex is a binding material that allows for high coating speeds, improved smoothness, higher gloss levels, opacity, and water resistance. Additionally, Trinseo provides other latex polymers used in carpet and artificial turf markets [7], [8].

Plastic Solutions: Trinseo's Plastics Solutions segment primarily focuses on producing various compounds and polymer blends, mainly for automotive applications. These products include ABS (Acrylonitrile Butadiene Styrene), SAN (Styrene Acrylonitrile), and PC (Polycarbonate). A significant part of this segment's offerings consists of blends like PC/ABS compounds, which combine the strengths of both polymers. The PC provides heat resistance and impact strength, while ABS offers easy processing and durability. The plastic solutions segment serves the automotive industry, creating lightweight, impact-resistant components such as car interiors [7], [8].

Feedstocks: The Feedstocks segment of Trinseo historically focused on the production of styrene monomer, a core building block in the creation of many plastic and rubber products. The critical function of this segment was to secure a stable supply of styrene for Trinseo's other business lines, especially for its polystyrene and latex manufacturing activities. Styrene monomer is essential in producing products such as polystyrene and synthetic rubber. Trinseo produced some of its styrene to avoid relying entirely on external suppliers, allowing for more predictable costs and supply security. However, as part of its restructuring strategy to reduce exposure to cyclical and lower-margin markets, Trinseo decided to exit the styrene production business, closing its production facilities in Boehlen, Germany, and Terneuzen, the Netherlands, by 2023. By moving away from producing feedstocks, Trinseo can now focus on purchasing styrene from third-party suppliers, optimizing its operations, and concentrating on higher-growth areas like sustainable materials and specialty plastics [7], [8].

Americas Styrenics: The Americas Styrenics (AmSty) segment within Trinseo is a joint venture between Trinseo and Chevron Phillips Chemical Company (each owning 50%), focusing on producing styrene monomer and polystyrene. Established in 2008, AmSty benefits from its parent companies' assets, combining Dow's polystyrene plants across the Americas with Chevron Phillips' styrene monomer plant in St. James, Louisiana. As one of the largest producers of polystyrene in the Western Hemisphere, AmSty plays a critical role in providing materials used in various industries. AmSty's products primarily serve markets such as food packaging, appliances, and construction materials. In food packaging, polystyrene's lightweight and durable properties make it ideal for disposable containers, cups, and packaging solutions. In the appliance market, polystyrene is used for the outer shells and internal components of electronics due to its impact resistance and ease of molding. Additionally, it serves the construction industry through insulation materials and building components [7], [8].

As previously mentioned, Trinseo built up approximately $1.2bn in debt from its LBO in 2010, but this was only the beginning of its path to an overleveled capital structure, as it made two acquisitions in 2021. Both these acquisitions, which totalled over $1.8bn, was expected to generate $256mm in pro forma EBITDA, but only provided $3mm LTM pro forma EBITDA by 6/30/2023 [2].

Arkema PMMA Acquisition [5]

Trinseo acquired Arkema’s polymethyl methacrylate (PMMA) business for $1.36bn, with approximately $250mm funded with existing cash and the remaining purchase price funded via new debt financing. The debt financing was arranged by Deutsche Bank and HSBC.

Aristech Surfaces Acquisition [6]

Trinseo also acquired Aristech Surfaces in 2021, a manufacturer of acrylic sheets and solid surface products, for $445mm, with no debt financing. Trinseo bought Aristech for around 7x EBITDA [10].

Events leading to Restructuring

Trinseo engaged in a financial restructuring (the double-dip) in September of 2023 (which we will discuss below), the company faced financial difficulties long before this.

Rising Energy Costs in Europe: Trinseo faced significant pressure from rising natural gas prices in Europe, especially following the economic fallout of the Ukraine conflict and energy supply constraints across the region. The company temporarily shut down its Boehlen, Germany, styrene production facility in late 2022 due to these elevated costs, leading to further restructuring efforts. While the Terneuzen, Netherlands, styrene plant was restarted in January 2023, high energy costs continued to challenge operations throughout the year. Elevated natural gas prices also resulted in natural gas hedge losses during 2023, negatively impacting profitability [4].

Supply Chain Disruptions: The global supply chain disruptions impacted Trinseo’s ability to maintain consistent production and distribution. The challenges were exacerbated by slower-than-expected recovery in global logistics post-pandemic and a mismatch between supply and demand for certain raw materials, further straining operations. These disruptions also limited the availability of key inputs, particularly for Trinseo’s polystyrene and plastics products, resulting in lower sales volumes and reduced profitability.

Softer Demand: Across several of its key markets, Trinseo experienced weaker demand, especially in sectors like appliances, building and construction, and automotive. This was partly driven by customer destocking, where clients reduced their inventories in anticipation of lower prices or slower demand. These trends led to a 38% year-over-year decline in net sales for polystyrene and a 61% drop in feedstock sales by the second quarter of 2023 [14].

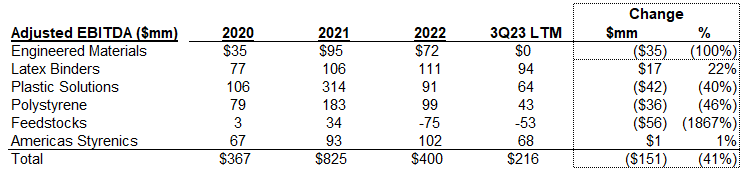

These factors led to the decline in LTM 2023 (as of Q3 20230) Adjusted EBITDA for Trinseo, as seen in Figure 3 below.

Figure 3: Trinseo Adjusted EBITDA Performance [10]

The decline in the engineered materials segment to $0mm in LTM 2023 was driven by lower volumes across all their products from weakened underlying demand and customer destocking in building & construction, consumer electronics, and wellness applications end markets [15].

The company also suffered from several regulatory issues, notably the class action lawsuit filed by investors. This class action alleged that the firm made misleading statements and did not disclose various facts about their business and operations, which would have deterred potential investors if properly disclosed. Although this class action was settled in May 2024 for 2.7mm, credit and equity investors are undoubtedly deterred from further investments in the company, which could pose problems if additional capital raises are needed [9].

By Q2’23, Trinseo had just under $270mm in cash, with $188mm in annual interest expense and an upcoming maturity wall in September 2024 [8].

Figure 4: Stock Chart

Transaction and Credit Doc Deep Dive

As a result of the company’s declining financial performance and large cash burn, Trinseo looked towards financial restructuring alternatives. Advised by Centerview Partners, Trinseo engaged in a pari-plus double-dip that featured a drop-down of the Americas Styrenics business entity. Below, we have outlined the various components of this transaction, and we will dive deep into each part. This can all be visualized below in Figure 5 [1],[10].

$1,077mm new money loan from Apollo, Angelo Gordon, and Oaktree. The 1,077mm term loan had a rate of SOFR + 8.5%, with an option to do SOFR + 4.25% cash plus 5.25% PIK interest for the initial two years [3], [10].

Intercompany Loan: $948mm pari passu to the existing borrower (Trinseo holdings) and $125mm equity contribution from Trinseo LuxCo [10].

Priority Guarantee: Non-guarantor restricted subsidiary and Americas Styrenics dropdown provide uncollateralized assets for the double dip creditors [10].

Figure 5: Trinseo Organizational Structure Post-Transaction

I appreciate that this picture seems very complicated but stay with me as we are going to break this down step by step very easily.

There are a few credit doc considerations that every company must look at when considering a double-dip.

Subscribe to Pari Passu Premium to read the rest.

Become a paying subscriber of Pari Passu Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Get Full Access to Over 150,000 Words of Content

- Institutional Level Coverage of Restructuring Deals

- Join Hundreds of Readers

- Exclusive Premium Writeups (Starting April 2025)