Welcome to the 92nd Pari Passu Newsletter,

Three weeks ago, we looked into a hot iteration of Liability Management Transactions: double-dips. As a reminder, this is a mechanic created naturally in capital structures over a decade ago made two claims for a single creditor group, effectively doubling their recoveries.

Over the past few years, we have seen double-dips emerge as a new form of transaction where creditors are now actively implementing verbiage in credit documents as a restructuring solution. These two claims typically come from intercompany loans and guarantees from the parent company or restricted guarantor subsidiaries.

However, recently, a proposal from the bondholders in Spirit Airlines (NYSE: SAVE) introduces a new concept: triple-dips. In this paper, we will first understand how triple-dips could be created. Then, we will analyze the real world case of Spirit Airlines and see the potential of the triple-dip as a revolutionary liability management maneuver.

Double-Dip Overview

Let’s get to it. Triple-dips are simply an extension of the double-dip transaction, so it is critical to understand the mechanics of the double-dip first. Simply put, a double dip transaction is when new financing is provided such that the lender is entitled to receive, at most, two times of their book value of debt provided. How we get to two claims comes from two sources: an intercompany loan and a guarantee from a parent/restricted entities. An intercompany loan is a lending agreement between two entities in the same corporate structure (hence the ‘inter’). Specifically, it occurs when one entity, let’s say Subsidiary X, lends capital or assets to Subsidiary/Parent Y. Because the capital has been lent, Subsidiary/Parent Y is indebted to Subsidiary X.

A guarantee is when one party provides an ‘assurance’ to another party in the same corporate structure. One of the key rules surrounding investing in debt across the capital structure is that lenders want to lend as close to where the true value of the company resides. Ideally, this means that lenders provide capital to the entity that holds the valuable assets of the entire company. Thus, the point of a guarantee is to ensure that claims that are held at different lengths from the key assets are treated pari passu rather than one claim being structurally subordinated to another claim.

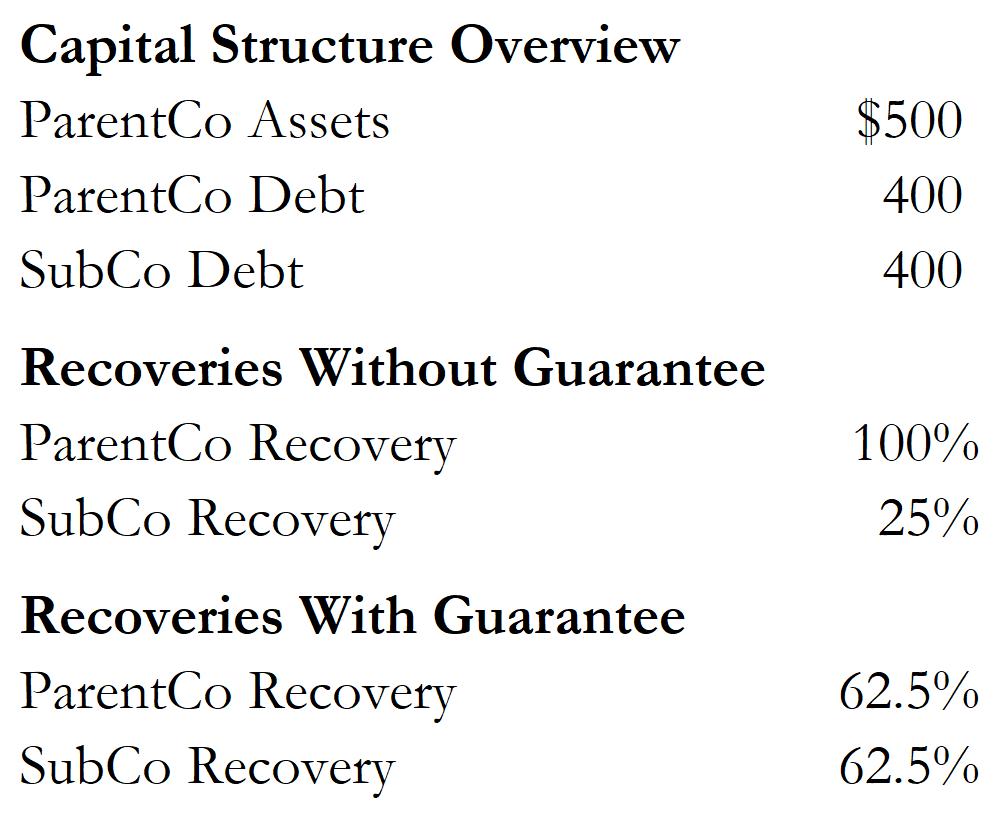

To explain this example further, let’s look at a waterfall with and without a guarantee. Let’s say that we have a capital structure consisting of ParentCo debt of $400mm and SubCo debt of $400mm. Additionally, we know that the assets, totaling $500mm, reside at the ParentCo. Because the ParentCo debt sits ‘closest’ to the assets, they have the first claim. Thus, in a situation without a guarantee, the ParentCo debt would receive 100 cents while the SubCo debt would receive 25 cents. However, with a guarantee extended from ParentCo to SubCo, the debt is now treated pari passu. Thus, the recoveries are now both 62.5 cents for both tranches of debt. This can be seen in Figure 1.

Figure 1

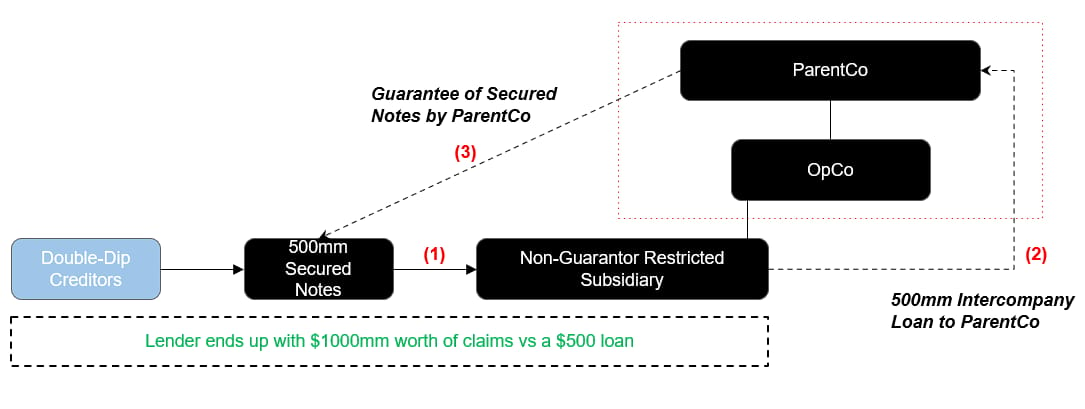

Now, we can apply this knowledge to visually demonstrate how double-dips are created. As seen in Figure 2, the double-dip has 3 components.

An entity lends money to an empty box (the non-guarantor sub).

This box then transfers that money (in the form of an intercompany loan) to another box (the restricted sub or ParentCo) with pre-existing debt / assets.

The ParentCo then guarantees the initial loan (pari to pre-existing debt), creating a second secured claim for the double-dip creditor . This creates two claims from one initial loan, thereby resulting in a double dip structure.

There are two important points to note: First, both the intercompany loan and guarantee can provide a recovery of at most par. This means that if the intercompany loan does not recover par, the guarantee cannot return above par such that the creditor can still receive two times recovery. Additionally, the reason we are saying, ‘under perfect conditions’, is because in reality it is very unlikely that double dip creditors receive two times their claim. Double-dips only provide value in a bankruptcy situation (either for liquidation or negotiating power in terms of what the true value of a claim is), and because the company is in bankruptcy, it is unlikely that it has the capital to return par to its creditors. Additionally, double-dips are heavily restricted by their credit docs. For example, oftentimes there is a guarantee cap in credit docs. This limits the amount of debt that an OpCo can guarantee, leading to a slightly below double recovery [13].

Figure 2: Double-DIP Structure [12]

Triple Dips

A structure that is just arising, however, is the triple-dip. The point of a triple-dip is simply to take a double dip, and determine if there is another claim that can allow a creditors claim to reach three times the book value of debt. The case of Spirit Airlines, which we will dive into later, is the first iteration of this mechanic and evidence that triple-dips can be created if the correct verbiage exists in credit documents. For Spirit, a third dip was created via Termination Damages, as the bond indenture included a clause specifying the cost of damages owed to bondholders if the brand IP licensing agreement is terminated. The other two dips came from the sources above: the ParentCo guarantee and an intercompany loan. However, the Spirit triple-dip is currently being subject to scrutiny and claims that the damage dip is not as strong as the bondholders initially claimed. That does pose the question: what are some other ways a triple-dip could be created. Although it is always going to depend on the credit doc, corporate structure, and what creditors are allowed to do, below are some possible ways that we have thought a triple-dip could be created. Note: these are just our thoughts, and by no means the ‘correct’ way to go about the triple-dip maneuver. In the end, a triple-dip will require large flexibility from the credit docs, and there could be endless ways for it to be structured.

Option 1: Subsidiary Structuring

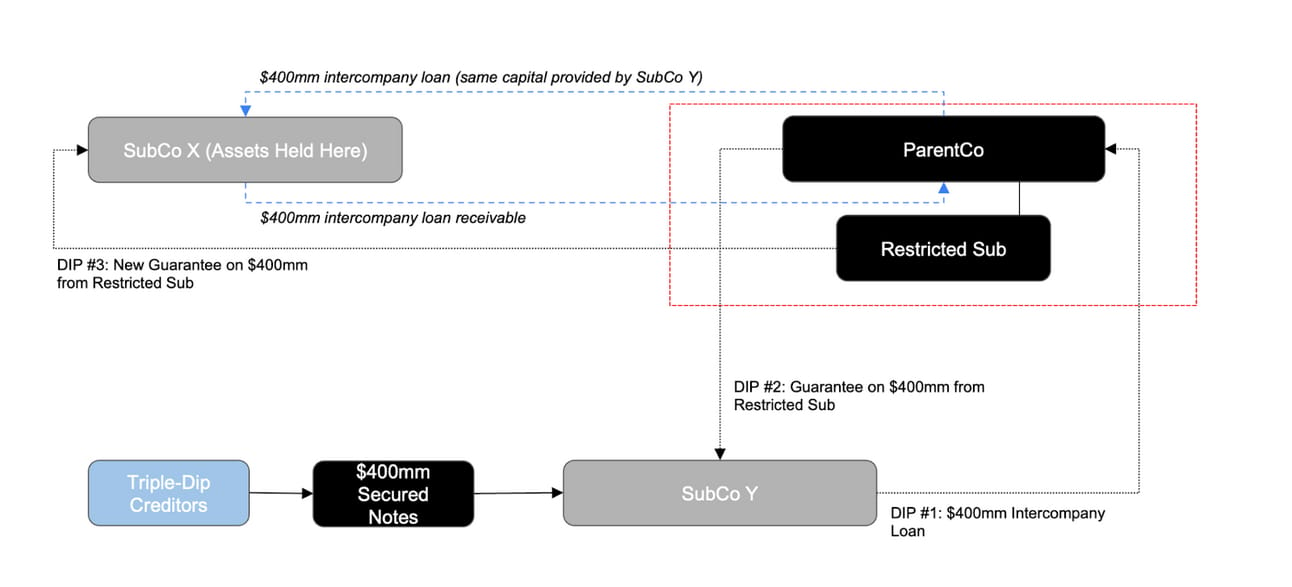

This version of a triple-dip is going to be the most dependent on the credit docs, but can be thought of as the most natural extension of a double-dip. In a double-dip, we gain two claims from an intercompany loan and a guarantee. Although it may seem simple to create a new subsidiary and provide another intercompany loan, for example, to get a third claim, this would not actually provide a triple-dip as this new intercompany loan still requires capital from a creditor group. Thus, to create a triple-dip ‘naturally’, we need to maneuver the existing capital around the corporate structure to gain an additional guarantee secured by the same pool of assets. Reference Figure 3 below for an example to demonstrate this idea.

Figure #3: Triple Dip - Subsidiary Structuring

While this diagram may look complicated, it is simply an extension of the double-dip seen in Figure #2. In this example, we have $400mm of Secured Notes being issued to SubCo Y. As in a standard double-dip, we have our first claim coming from an intercompany loan to the ParentCo. Our second dip comes from the guarantee from the restricted subsidiary on the $400mm debt issued by the triple-dip creditors. Now, to create the third dip, we need to gain an additional claim. To do so, one method could be to transfer the debt held at ParentCo to SubCo X via an intercompany loan. The debt held at SubCo X can then be guaranteed again by the Restricted Sub, creating a third claim. In order to move assets in and out of the credit box like the example above, there needs to be a lot of credit doc flexibility.

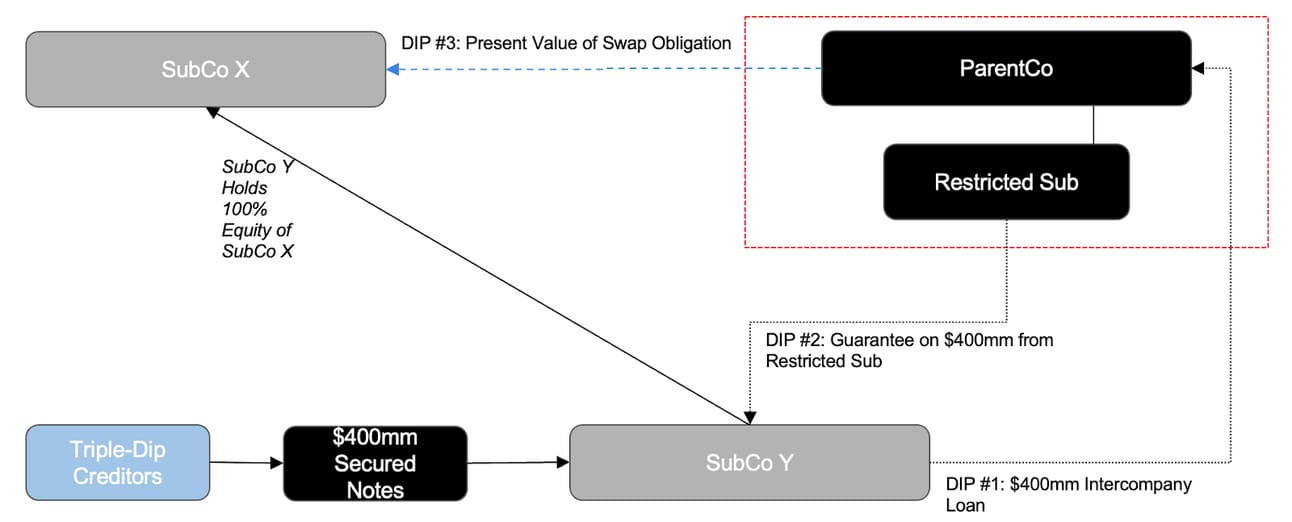

Option 2: Intercompany Derivative/Capital Structure Instruments Structuring

A company could use swaps, options, and other derivative instruments between subsidiaries to create a third claim. Like the intercompany loan, a derivative instrument represents a contract between two parties, and if structured appropriately, it could represent additional recoveries for the triple-dip lenders.

Figure #4 below depicts how this structure could arise. As it was in Figure #3, there is a first claim from the $400mm intercompany loan, and a second claim from the $400mm restricted company guarantee. However, the third claim is created via an interest swap contract entered into between SubCo X and ParentCo (using the $400mm upstreamed from SubCo Y). To briefly explain how swap contracts work, it is an agreement between two parties to exchange their interest payments for one another over a set period of time. Let’s say that we have a mortgage of $1,000,000, with a 10% fixed interest rate. If we believe that interest rates are going to be lower than this rate over the duration of a swap contract, an individual can engage in a swap contract with a bank. To do so, they would swap their 10% fixed interest rate for a rate that the bank provides, say SOFR + 2%. If the contract lasted 5 years, each year the bank would have to pay the 10% rate and the individual would only have to pay the SOFR + 2%.

In our example swap contract, we can assume that it has a notional value of $400mm, where SubCo2 pays a fixed rate (i.e 5%), and ParentCo pays a floating rate (i.e SOFR+3%). If, at the time of the filing, the present value of the swap contract is positive to the benefit of SubCo X, it becomes an additional claim. Thus, if that swap contract reached a present value of $400mm, a third claim could be created.

Figure 4: Triple DIP - Swap Contract

There are a few conditions for the swap contract to occur.

Subscribe to Pari Passu Premium to read the rest.

Become a paying subscriber of Pari Passu Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Get Full Access to Over 150,000 Words of Content

- Institutional Level Coverage of Restructuring Deals

- Join Hundreds of Readers

- Exclusive Premium Writeups (Starting April 2025)