Welcome to the 103rd Pari Passu Newsletter,

While everyone (myself included) loves talking about private credit, there is another form of debt financing that is having a record year: Whole Business Securitization (WBS), the topic of today’s newsletter.

Although the Federal Reserve’s recent rate cut has equity investors and businesses optimistic about upcoming financing opportunities, the past two years of higher interest rates demanded companies be creative in addressing capital needs. This newsletter will provide an overview of how a WBS structure works financially and within a corporate structure and showcase a real example of Roark Capital’s Subway Acquisition.

But first, a message from 10 East

10 East, led by Michael Leffell, allows qualified individuals to invest alongside private market veterans in vetted deals across private credit, real estate, niche VC/PE, and other one-off investments that aren’t typically available through traditional channels.

Benefits of 10 East membership include:

Flexibility – full discretion over whether to invest on a deal-by-deal basis.

Alignment – principals commit material personal capital to every offering.

Institutional resources – a dedicated investment team that sources, monitors, and diligences each offering.

10 East is where founders, executives, and portfolio managers from industry-leading firms diversify their personal portfolios.

There are no upfront costs or minimum commitments associated with joining 10 East.

Whole Business Securitization Overview

Debt financing nowadays typically comes from three sources: bank debt (typical banks, financial institutions issuing loans or revolvers and secured against assets), bonds (issued by the company and sold to a pool of investors that can be secured or unsecured and trade in the public markets), and more recently, private credit (nonbank lenders such as private equity firms, hedge funds, and specialized credit issuing direct lending and mezzanine debt which can provide bespoke solutions across capital structure which can be secured or unsecured). When a company looks to raise capital via these sources, it is critical to understand the various terms they are giving up in exchange for raising capital. These terms range from specific interest rates to covenants on what a company can and cannot do.

Whole Business Securitization has started to gain popularity, especially in a higher-rate environment, which we have been in for the past few years. This is because, as we will discuss, WBS can aid in lowering general debt costs for the company. Banks and bond investors typically offer WBS. Unlike traditional financing, WBS structures require creating new corporate structures that hold operational assets, IP, franchise agreements, or other value assets where debt is lent directly against those assets. Once those assets are in the new corporate structure, the legal documents “ring-fence” the assets in a credit box so only the WBS debt has a secured claim against those assets.

There are two main types of business structures where this financing makes sense. First, it is companies with valuable IP, as the majority of their assets are going to be held in IP, making it easier to move those assets into a new corporate structure. Second, it makes sense for a company whose primary source of revenue comes from recurring contracts, as they also represent the majority of the business’s assets and can easily be moved to a new corporate structure. Covenants in WBS structures vary from deal to deal but differ substantially from traditional debt financing. Because the operational assets are ring-fenced directly to the lenders, maintaining the assets' value is the most critical task, as it provides refinancing abilities in the future and a strong recovery in downside cases. Many of these structures have triggers to prevent an event of default in the WBS structure, such as interest coverage ratios, which measure if a company’s cash flows can cover its interest expenses. Under traditional debt financing, companies have many covenants, and a breach of that covenant would constitute a default. Under WBS, there are a variety of provisions in place that would not typically be found in debt financing credit documents. These provisions are ‘triggers’ or ‘warnings’ for the company. For example, if a company comes close to breaching one of its covenants, but has not yet, a WBS credit document would have a trigger in place before the breach that would require the company to have management evaluate the situation and have enforced meetings with consultants to remedy their operational issues [1].

Profits are also treated differently in a WBS. After the cash services the WBS interest payments, the remaining cash typically has no restrictions. In contrast, typical structures and debt financing restrict how much cash can be deployed as dividends or share buybacks. A WBS structure can lead to significant yearly dividends, asset improvement, reinvestments, and more, as long as specific ratios are covered and the operational assets maintain their value. Suppose ratios are breached or assets deteriorate below the set threshold. In that case, the ring-fenced WBS structure locks up, stopping the cash from exiting the structure until a cure occurs, which can be an equity injection to improve assets or pay down debt. This requires owners to balance reinvestment into the business and returns, as there is greater freedom than typical financing restrictions [1].

Outside the WBS, parent companies typically hold equity interest in the WBS, receiving dividends for profit. The operational assets, IP, and everything else within the WBS are bankruptcy remote from the parent. This means that if the parent company filed for Chapter 11, the operational assets and cash flow from the WBS are not accessible for recovery in the parent company’s filing and are not considered part of the bankruptcy estate.

This is important to understand as it’s the key difference between secured debt and WBS. In the case of secured debt, the collateral of secured debt can then be used to support the reorganization (and might get stripped away if the court believes the creditor is given “adequate protection”). On the other hand, assets that are part of a WBS are not considered bankruptcy estate. This gives lenders even more protection in a downside scenario [1].

As a point of clarification, there are two ‘owners’ as a result of the WBS process. The HoldCo/ParentCo is still held by the original company and original management in place. Within the OperatingCo that is part of the securitization, management is still being run the same way it was prior to the securitization (although, sometimes, new managers are hired). The assets are still ‘technically’ owned by the ParentCo, but because the majority of the business is securing creditors, those creditors effectively have ownership of the company, as in the event of default all assets would cover their debt only.

The most significant legal challenge in finalizing WBS structures is creating a bankrupt remote operating company that remains excluded from the parent company. This requires a true sale, where the new owner of the assets has complete credit risk, and the asset is separated from the seller’s balance sheet, leaving the new owner with only claims against the asset. In a standard sale, the seller may still have financial claims against the sold asset. The asset transfer must be without recourse (the parent company no longer has any legal right or financial interest in the transferred assets) so that the parent company no longer benefits from a change in the value of the operational assets. Secondly, as the core company operations are now removed from the parent company, the two corporations must now work as separate businesses so that the parent creditors do not have any claim on the operational assets and there aren’t any consolidation risks in bankruptcy [1].

WBS structures are attractive to companies due to the lower cost of capital, which means they can raise debt capital at lower interest rates than other sources of financing. With the debt being lent against most, if not all, operational assets, the WBS lenders have the highest priority in recovery due to their proximity to the company’s valuable collateral. Given the royalty and franchise contracts, typically spanning across the country, there is diversification of cash generation, leading to less risk for lenders. Due to the predictability of the businesses suited for WBS structures, the maturities can be abnormally long (ranging up to 50 years), and coupons are typically lower (only a couple of points above SOFR) due to the stability and security [1].

Negatives & Considerations for WBS Structures

Some key risks for WBS structures stem from the long-term horizon and the higher-than-typical leverage associated with financing. By leveraging a company with massive amounts of debt containing minimal amortization, the company will consistently need to generate cash flow to pay off interest payments over an extended period. Additionally, the operational assets inside the WBS used as collateral may be all of the company’s assets, compared to traditional securitization, where debt is only secured by some of a company’s assets. Per Fitch, WBS structures can and have allowed some companies with a B-credit rating to issue investment-grade debt.

From both a company's and a creditor’s perspective, the ‘locking up’ of assets has negative implications. For a company, it gives them less flexibility, both financially and operationally, as they will not be able to freely move cash and assets to various entities as needed. Additionally, from the creditor’s perspective, WBS limits their ability in distressed situations, which is something every creditor has to consider when lending capital. In the past 5 years, there has been an increased use of liability management transactions where collateral shifts around and debt priority is changed. This may not be possible due to the legal structure of the WBS entity.

Hypothetical WBS Structure

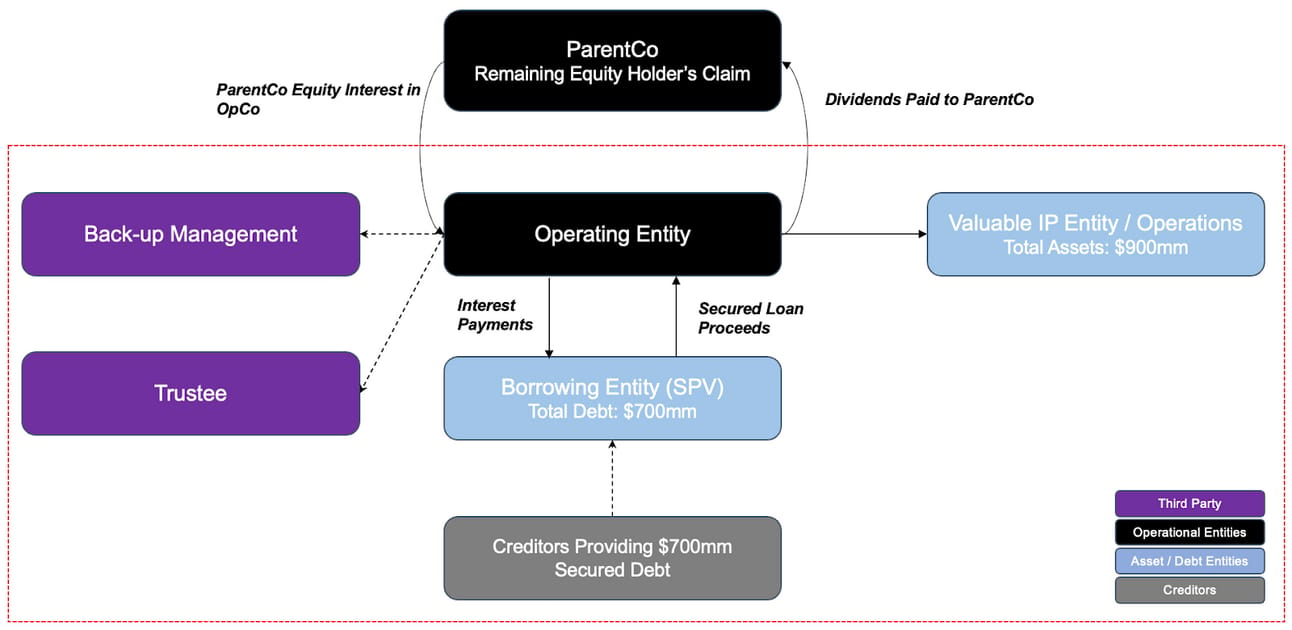

Figure 1: Hypothetical WBS Structure [1]

Let’s take the hypothetical example above to fully understand how value flows in a WBS structure. Upon creation, the valuable assets (in this case, valuable IP) will be transferred to an entity in the ‘ring-fence’ (seen in red). Those assets will be owned by the operating entity, where the fundamental operations of the business are run. This operational entity has 3 different roles/connections.

Creditors: The proceeds for the capital raised under the WBS are transferred to a borrowing entity, which is structured as an SPV for the various reasons we discussed above. Those proceeds in the SPV are upstreamed to the operating entity, which will help fund operations as well as dividend payments to ParentCo.

ParentCo: Remember, a key part of the WBS process is having the ParentCo retain an equity interest in the Operating Entity. The ParentCo benefits from this equity interest in the form of dividends, which will be funded via the capital raise as well as the general operations of the Operating Entity. It is important to note that interest has a first claim on the cash flows that OpCo generates, and then OpCo can use excess cash as it sees fit (i.e. dividend payments).

Subscribe to Pari Passu Premium to read the rest.

Become a paying subscriber of Pari Passu Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Get Full Access to Over 150,000 Words of Content

- Institutional Level Coverage of Restructuring Deals