Welcome to the 72nd Pari Passu Newsletter.

Today, we are learning about the practice and methodology behind investing in banks, whether that is breaking down the unique valuation philosophy, decoding the most important metrics, discussing the fundamentals of the business, and understanding the dividend discount model (plus Professor Damodaran’s unique model). It has been a wild ride in the banking sector recently, and it has moderately recovered since the collapse of Silicon Valley Bank on March 10, 2023. Today’s essay will be dense and long, but I truly believe that gaining a basic understanding of this sector can make us better investors overall.

This essay is divided into three main sections:

Fundamental Analysis

Technical Understanding

Valuation.

Let’s dive in.

Part 1: Fundamental Analysis

Banks 101

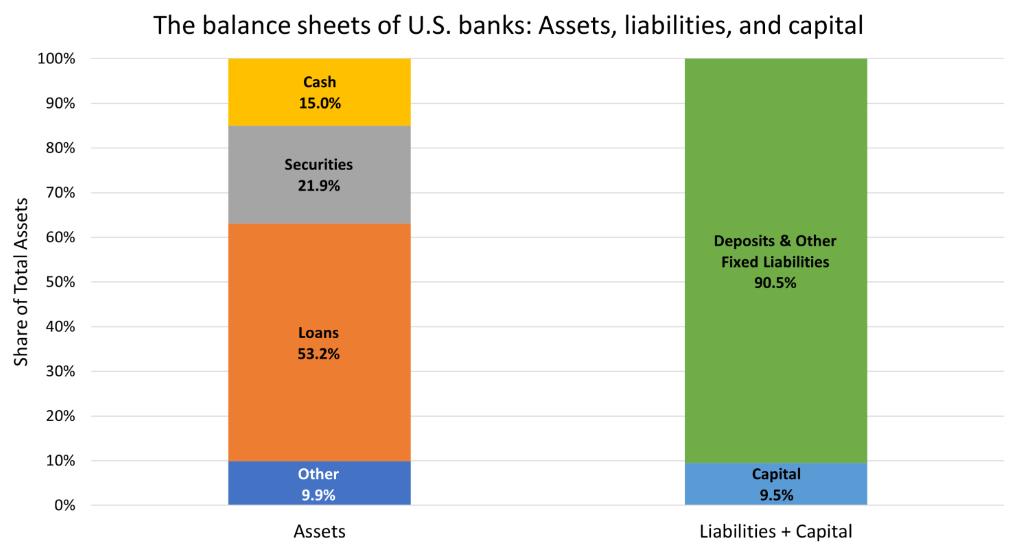

At the most basic level, a bank makes money by borrowing money from depositors (and other creditors) and using the money to make loans and buy securities (and at times engage in higher-risk investments). If the investments end up being worth more than the deposits, the shareholders keep what’s left. As simple as that.

We now understand that banks and operating companies use debt in a completely different way. Banks, at their core, leverage debt not merely as a liability but as a foundational element to operate. This distinctive approach to debt transforms this sector into an asset class of its own, albeit one with complex implications for valuation and risk assessment.

If you might be wondering why banks have to use leverage while operating companies do not, you are on the right path to understanding the model. Technically, banks do not have to use leverage, but without it, the model would not be profitable enough to attract capital. Let’s assume a bank that does not take deposits (or any other type of liability), and finances all its business with $100 of equity. On average, it lends money at 4% interest generating $4 of profits and a ROE of 4%. Not cool.

On the other hand, let’s assume that the bank borrows $90 (in the form of deposits) paying 2% interest on these deposits, and now investors commit just $10 of equity. On average, the bank still lends money at 4% interest generating the same $4 of profits. In this case, the bank incurs an interest expense of $1.8 (the interest it has to pay to people who deposited the money) leading to $2.2 of profits. The equity is now $10, therefore the ROE is 22%. Much more cool.

Now that we understand the model at the most simple level, let’s get into the details.

Background Knowledge

In analyzing the financial sector, certain positive factors emerge that can significantly impact its performance. A moderate rise in interest rates, for instance, augments the profitability of banks by increasing the spread between what they pay on deposits and what they earn on loans. Similarly, a reduction in regulatory constraints can enhance operational efficiency and profitability by alleviating compliance costs and fostering a more conducive business environment. Moreover, lower consumer debt levels reduce the risk of default, potentially leading to increased lending activities and profitability due to a healthier consumer base willing to take on new debt. Conversely, the sector faces challenges that investors must carefully consider. Rapid increases in interest rates could dampen the demand for credit, affecting banks' core lending activities. A flattening yield curve (where the spread between long- and short-term interest rates narrows), can squeeze banks' interest margins, impacting their profitability. Furthermore, increased regulation, while aiming to protect consumers and ensure financial stability, can introduce operational complexities and costs, potentially limiting agility and growth [3] [6].

The financial structure of banks is underpinned by the concept of bank capital (equity), which serves as a vital cushion against losses. This capital, representing shareholders' investment, is not a liability in the traditional sense but an essential buffer that ensures a bank's resilience against insolvency. Regulatory bodies globally mandate banks to maintain a minimum capital ratio to safeguard against systemic risks, ensuring that banks operate with a prudent balance between pursuing profit and maintaining stability. However, the cost of capital is higher for banks than other forms of financing, such as deposits or loans, making it a critical factor in their financial strategy. Banks aim to optimize their capital levels to satisfy regulatory requirements and stakeholder expectations while minimizing costs to enhance profitability. In general, the more capital a bank requires, the lower its profitability [11]. This is what a typical balance sheet structure may look like:

Regulation-wise, the Basel Committee on Banking Supervision plays a pivotal role in shaping the global regulatory framework for banks. Established in the aftermath of the GFC, the committee's Basel III measures aim to fortify banks against future crises by enforcing stricter capital, risk management, and supervisory standards [11].

These measures emphasize the need for banks to hold sufficient capital against various risks, including credit, operational, and market risks. The operational risk component, in particular, highlights the need for robust internal controls and processes to mitigate losses from internal failures or external events, affecting banks with significant non-lending activities the most. Typically, there will be more regulatory impact on the capital requirements of banks that have more business outside of lending like wealth management and other fee-generating businesses.

Banking Landscape

Subscribe to Pari Passu Premium to read the rest.

Become a paying subscriber of Pari Passu Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Get Full Access to Over 150,000 Words of Content

- Institutional Level Coverage of Restructuring Deals