Welcome to the 121st Pari Passu Newsletter,

Today we are learning about a counterintuitive example of Chapter 11. When people think about the most common cause of a distressed business, there’s a good chance they might say a decline in demand for goods and services. Whether a macroeconomic event or overleveraging plays a part, a restructuring often arises as the result of a mismatch between management’s expectations and reality.

The case of Enviva is the opposite. It was Enviva’s attempts to meet the soaring demand for its products that caused the company to go under. This report details Enviva’s rapid growth, causes of distress, and the fatal mistake that led to its Chapter 11 bankruptcy last year.

Enviva Overview

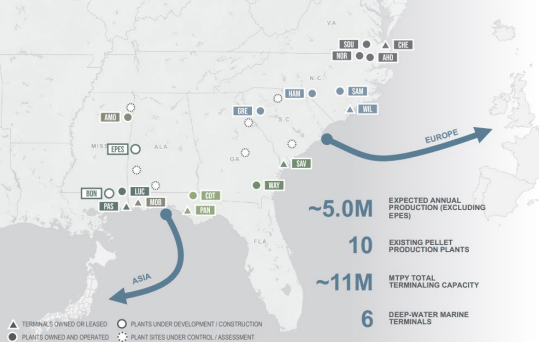

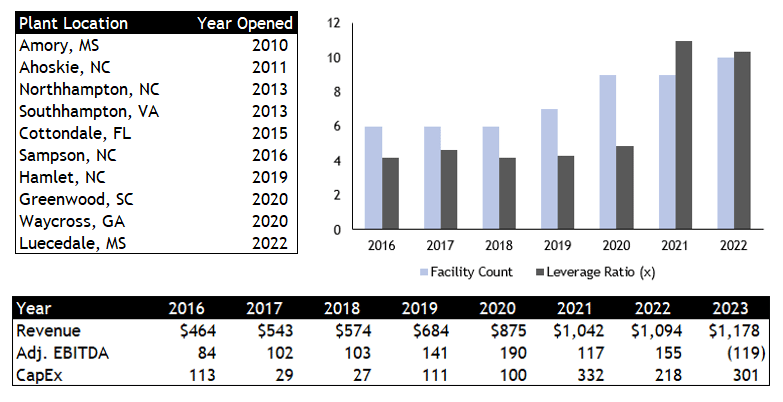

Enviva, Inc. was the world’s largest producer of industrial wood pellets, a renewable substitute for coal in power generation. The company was founded in 2004, and IPO-ed in 2015 under the EVA ticker on the New York Stock Exchange, valuing the company at north of $400mm. Enviva currently owns and operates 10 wood pellet production plants located across the southeastern United States. The company has also been developing two more plants: One in Epes, Alabama, and the other near Bond, Mississippi (we’ll return to this later) [1].

Enviva sources wood residuals from hundreds of timber industry participants in the southeastern United States. The company then processes the wood fiber into pellets and ships them internationally from 6 deep-water marine terminals located near its production facilities. Enviva’s terminals act as port facilities, providing direct deep-water access to large cargo ships, while also allowing the company to store large quantities of ready-to-ship pellets. Much of Enviva’s demand comes from large biomass facilities in the E.U., U.K., and Japan, as the wood pellets meet the criteria put forth by the European Union’s Renewable Energy Directive (“RED III”). Enviva’s wood pellets are viewed as a practical and renewable “drop-in” alternative to coal because of their similar attributes [1].

Figure 1: Enviva’s Production Facilities and Terminals [1]

Financial History

Growth

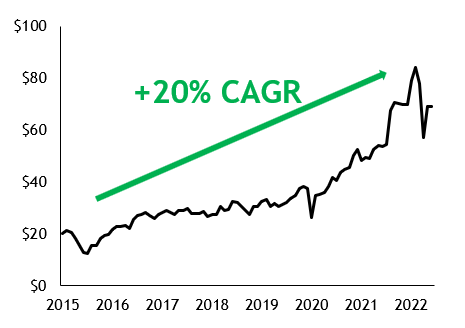

Enviva has operated successfully under long-term, take-or-pay contracts with customers, which require Enviva’s customers to pay for the contracted shipments, regardless of whether they can accept the shipment. The average contract had approximately 12 years remaining as of August 2024 [1]. The company grew its top-line revenue by 15% annually from 2016 to 2023 and generated $1.22bn in FY 2023 revenue. Enviva operated at a slim margin, with gross margin hovering around 20% each year, and posted either marginal net gains or losses. Regardless, a growing topline and increase in demand for renewable energy was enough to send Enviva’s share price soaring, nearly quadrupling over the 7 years following the IPO [2].

Figure 2: Enviva Share Price From IPO to 2022 [2]

Financing Aggressive Expansion

To keep up with increasing demand, Enviva opened 10 production facilities over the course of 12 years. Excluding the ~$200mm in proceeds from Enviva’s IPO, much of these capital expenditures were funded via the issuance of new debt. Enviva reported debt of $433mm in 2016, which grew quickly to $1.09bn in 2020. Over the same period, Enviva was able to keep up with its growing debt burden, more than doubling adjusted EBITDA from $83mm to $190mm and maintaining a leverage ratio of roughly 5x [2].

In the following years, it seems that Enviva bit off a little bit more than it could chew. In December 2019 and July 2020, Enviva issued new senior 6.5% unsecured notes worth $750mm due 2026 (the “2026 notes”). In July 2022, Enviva issued $250mm worth of tax-exempt green bonds for the construction of the Epes plant (the “Epes Green Bonds”). The company also issued $100mm of the same type of bonds for the construction of the Bond, MS facility (the “Bond Green Bonds”). These 3 securities made up the bulk of unsecured claims during Enviva’s 2024 Chapter 11 filing [1].

Figures 3, 4, 5: Enviva’s Production Facilities, Financials, and Leverage Ratio Over Time [2][4]

In 2021 and 2022, increasing costs for raw materials, labor, and shipping shrunk Enviva’s Adj. EBITDA margin from $190mm in FY 2020 to $117mm and $155mm in FY 2021 and FY 2022, respectively. These shrinking margins, coupled with Enviva’s financing for their new facilities, caused the company’s leverage to balloon to over 10x Adj EBITDA [2]. Total debt reached $1.6bn in 2022 and Enviva was footing an interest expense of $72mm, which may not seem like much for a $5bn+ company, but Enviva’s slim margins and poor decision-making would turn this into a catalyst for distress.

Causes of Distress

Ultimately, it was a series of unfortunate events – and poor decisions – that derailed Enviva’s growth and plunged them into a default and Chapter 11. These factors can be boiled down into global/environmental events, overleveraging, and poor decision-making within the wood pellet spot market. These 3 causes worked in tandem to nearly incinerate Enviva’s ability to operate as a going concern. Therefore, rather than separately addressing each cause, it’s best we approach Enviva’s distress as the chain reaction it was.

Let’s rewind back to 2022 – an era of rapid inflation, supply chain disruptions, and the beginning of the Russia-Ukraine war. Enviva was facing significant increases in operational costs. The price for wood residuals was at an all-time high, and demurrage costs associated with loading, transporting, and unloading wood pellet shipments stemmed from port congestions in Europe and Asia. To clarify, Demurrage fees must be paid when cargo remains at a port or terminal for longer than the agreed time outlined in a shipping contract. Enviva engaged in 2 types of shipping agreements: Cost, Insurance, and Freight (CIF) and Free on Board (FOB). CIF contracts require Enviva to cover all expenses and risks associated with the shipping of its wood pellets until they arrive at the destination. On the other hand, FOB contracts pass ownership to the customer once the pellets are loaded onto the ship. Because Enviva primarily engaged in CIF contracts…

Subscribe to Pari Passu Premium to read the rest.

Become a paying subscriber of Pari Passu Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Get Full Access to Over 150,000 Words of Content

- Institutional Level Coverage of Restructuring Deals

- Join Hundreds of Readers

- Exclusive Premium Writeups (Starting April 2025)