Welcome to the 60th Pari Passu Newsletter,

Today we are diving into a fascinating story: Carvana. Tracked from their point of inception, the two companies that broke into the Fortune 500 the fastest were Amazon and Google. The third? Carvana [1].

In August 2021, Carvana (NYSE: CVNA) commanded a peak market capitalization of over $30bn. Known for its multi-story glass tower car vending machines, the company was the fastest-growing online used car dealer among several players seeking to disrupt the traditional dealer distribution model. Since its founding, Carvana has successfully delivered over four million cars through an in-house distribution network servicing over 80% of the US population [22].

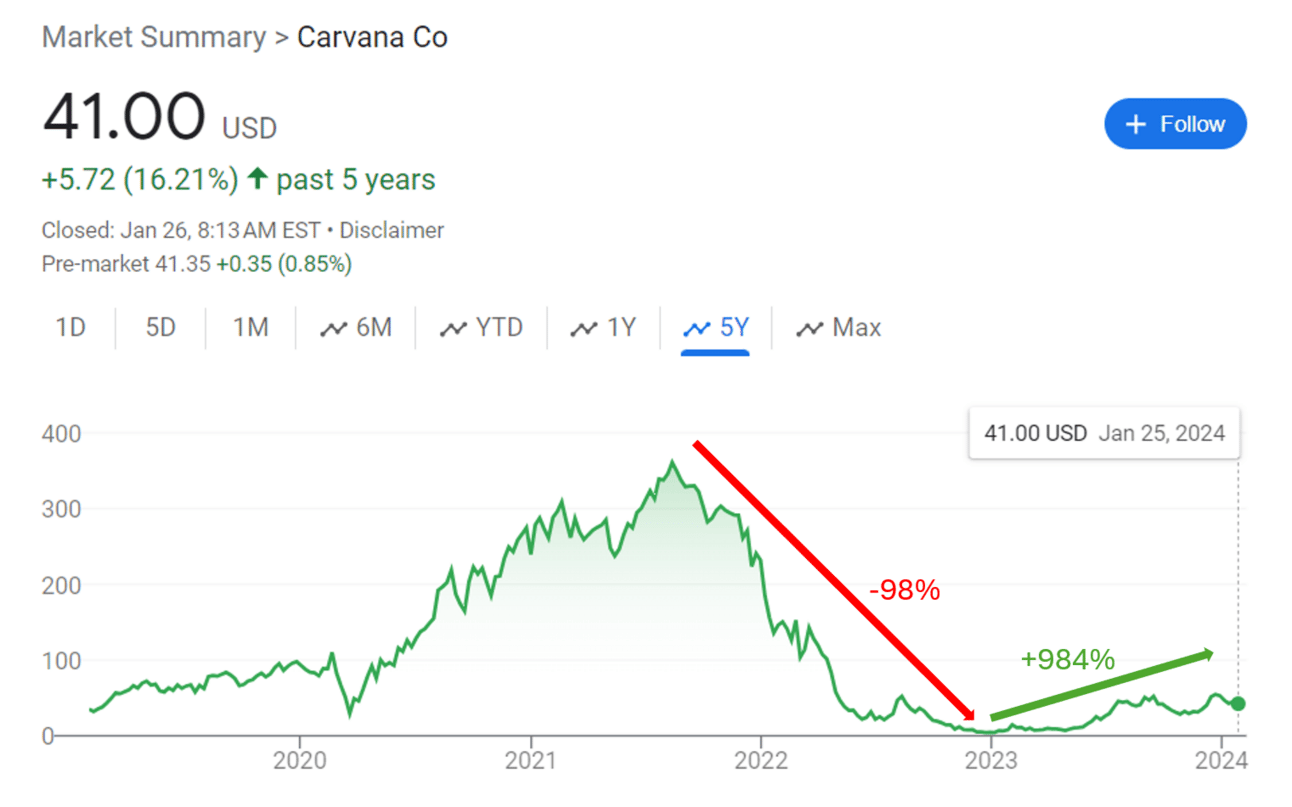

By the end of 2022, however, Carvana’s shares had fallen from an all-time high of $360.98 to an all-time low of $3.72. Today, we will understand the rapid rise and fall of Carvana, as well as the critical role of Carvana’s recent out-of-court restructuring in the company’s potentially ongoing comeback.

Ramp works with over 25,000 businesses to help them run their companies more efficiently. We recognize the critical role that finance automation plays in driving value creation for PE firms. With Ramp, you can reduce operating expenses and drive efficiencies across your portcos with real-time spend visibility and Al-powered insights. Time is money. Save both with Ramp.

Automate your finance operations, all in one platform.→ Corporate Cards→ Expense Management→ Travel Management→ Accounts Payable→ ProcurementJoin the hundreds of private equity and venture capital firms already partnered with Ramp

Chapter 1: The Origins of Carvana

The Carvana story begins at Stanford, where Ernie Garcia III and Ben Huston met as sophomores. While Garcia began his career in finance at RBS Greenwich Capital and Huston entered the legal field as an associate at Latham and Watkins after attending Harvard Law School, the two reunited in 2011 to start Looterang. While Looterang, a mobile app offering local, personalized deals off a proprietary algorithm, failed due to their lack of expertise, the duo, joined by Ryan Keeton, decided to pivot to a new business [1].

The trio decided to pursue an industry that at least one of them knew thoroughly. Garcia’s father, Ernest Garcia II, owns and operates Drivetime Automotive, the fourth-largest used car retailer in the United States. Since the age of 15, the younger Garcia had worked at the company every summer, learning the car business. As a result, the automotive industry was selected by the trio, who noted that the automotive industry is the biggest consumer vertical in the United States and has been historically known for poor customer experience. The elder Garcia allowed the trio to build Carvana, intended to become the “Amazon of cars,” as a subsidiary of DriveTime [1, 2].

It is worth noting that the elder Garcia had experience running a public company, Ugly Duckling, before it was rebranded to DriveTime Automotive. After receiving a felony conviction stemming from fallout related to the Lincoln Saving & Loans scandal (five Senators had improperly intervened with regulators on behalf of the bank in return for campaign contributions), Garcia II, then a Phoenix real estate developer, decided to enter a different business. He acquired Ugly Duckling, a rental car chain, and merged it with a tiny finance company. Utilizing the new company’s combined capabilities, he was a seller and financier of used cars focused on customers with weak credit histories. As the stock market performed well in the 1990s, Garcia II raised $170mm via IPO. However, in 2002, after Ugly Duckling’s stock price had fallen from over $25 to $2.50, Garcia II took the company private again, repurchasing the shares he did not own for $18mm. Investors sued, saying they hadn’t been treated fairly, but the lawsuits failed to pan out. The take-private proved to be a savvy decision, as DriveTime eventually grew to have revenues of $2.5bn and a private valuation estimated to be over $1bn. Lessons learned from Garcia II’s operation of DriveTime appear to have influenced Garcia III and his team since Carvana’s early days [2].

Chapter 2: Carvana Accelerates

Subscribe to Pari Passu Premium to read the rest.

Become a paying subscriber of Pari Passu Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Get Full Access to Over 150,000 Words of Content

- Institutional Level Coverage of Restructuring Deals