Welcome to the 159th Pari Passu newsletter.

Last week, the First Brand UCC objected to the proposed DIP, calling it the “product of unprincipled overreach by the Ad Hoc Group/DIP Lenders and desperation by the Debtors.” Yet, as most expected, the committee offered no alternative proposal. Markets are competitive, so how can a “shockingly expensive” proposal come out on top? Isn’t DIP financing supposed to be bulletproof?

Have there been recent cases where the DIP was impaired? Yes, and this bankruptcy is the topic of today’s edition.

In general, if you are a creditor in a company that filed for Chapter 11, it is almost always advantageous to provide the debtor with DIP financing (especially when returns can be ‘juiced’ with incentives such as roll-ups and fees). Beyond the fact that you are arguably being compensated more than the relative risk associated with a DIP loan, it is incredibly advantageous because these loans almost always remain unimpaired. However, DIP lenders will occasionally find themselves in a precarious position where their DIP claim is impaired (i.e, the value of the company will not provide a 100% recovery to DIP lenders).

These situations are rare, forcing DIP lenders to navigate this environment carefully to avoid capital impairment. Today, we are going to be looking at one of the more recent situations where DIP lenders remained impaired: the case of Audacy’s bankruptcy.

SBIC applications just surged 285%. Why should you care?

If you’re raising a private credit fund right now, you know the terrain is rough: high rates, tight fundraising, LPs with sky-high expectations. Enter the Small Business Investment Company program: A not-so-secret weapon offering government-backed leverage, bank LP access, and a lower cost of capital. But getting to your first Small Business Administration drawdown? It’s not plug-and-play. That’s why Carta made their newest whitepaper: "So you’re pursuing an SBIC license: What comes next?"

A tactical guide for private credit managers ready to navigate the complexities of setting up and operating an SBIC. What’s inside:

Step-by-step from license to leverage

How to align capital calls with SBA drawdowns

Compliance must haves (yes, Form 468)

Operational workflows every fund needs

Background

Audacy (formerly known as Entercom Communications Corp) was founded in 1968, acting as a pioneer in the FM radio industry. By 1999, the company had grown to a leader in the space and completed a successful IPO on the NYSE. Since its IPO, the company has adapted and changed its operations to provide a multi-platform media business, offering services including radio, digital streaming, podcasts, and various advertising solutions. In 2017, Audacy made the second-largest acquisition in the FM radio industry by acquiring CBS Radio, marking the company as a key player in the space [1].

Broadly, Audacy’s products can be broken down into 3 categories: Audacy Audio Content, Audacy Broadcast Radio, and Audacy Digital Media.

Audacy’s core product is the creation of premium audio content across a wide spectrum of genres and formats. This includes local and national news, live sports coverage, music programming, and podcasts [1].

Local News and Talk Radio: Audacy is the nation’s leader in local news radio. It operates seven of the eight most listened-to all-news radio stations in the United States. These stations dominate the “All News” format, capturing 81% of all listening in that category among the top 10 U.S. radio groups.

Sports Broadcasting: Audacy is a major force in live sports radio. The company holds broadcast rights for over 40 professional sports teams, spanning the NFL, MLB, NBA, and NHL, as well as dozens of top college athletic programs. These partnerships position Audacy at the center of sports media in many key local markets.

Music Programming: Audacy delivers curated music experiences via its terrestrial and digital properties. Its music programming includes top-charting songs, live performances, and exclusive artist content. Across all formats, over 118 million people engage with Audacy’s music content monthly.

Podcasts: Audacy is a dominant player in the podcast space, generating more than 150 million monthly downloads. The company owns and produces some of the most popular shows in the U.S., such as We Can Do Hard Things (Glennon Doyle), Fly on the Wall (Dana Carvey & David Spade), and the CBS Sports Podcast Network

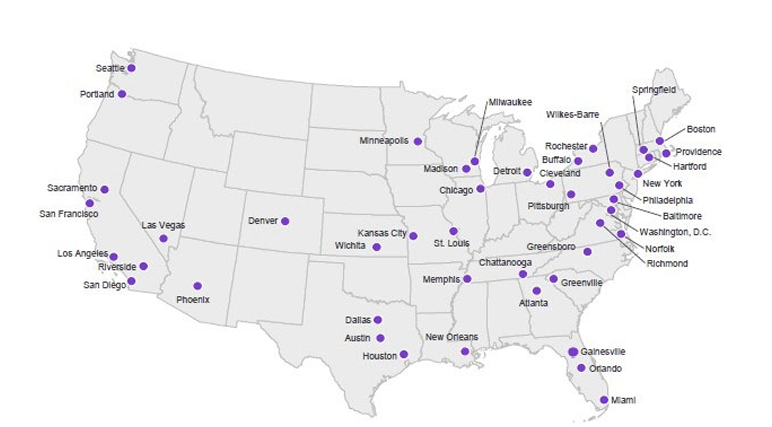

Audacy is the second-largest radio broadcaster in the United States (in terms of number of radio stations and markets reached), with an extensive footprint that reaches a majority of the American population. Its radio business forms the foundation of its legacy operations and continues to play a crucial role in the company’s content distribution and advertising model. The company operates over 225 radio stations in nearly every major market, including 20 of the top 25 largest U.S. markets (see Figure 1 below). This includes key cities like New York, Los Angeles, Chicago, and San Francisco. In over 70% of the markets in which it operates, Audacy either ranks #1 or #2 in terms of listener share in the overall radio broadcast market. Due to this moat, its radio broadcasts are reported to reach 83% of the overall radio broadcasting customer base in the top 50 radio markets [1].

Figure 1: Audacy’s Markets Served Across the U.S. [1]

Finally, Audacy’s last offering is its digital media base. In recent years, Audacy has invested significantly in expanding its digital capabilities, transforming itself into a modern multi-platform audio company. This growth has been centered around the development of the Audacy app, which acts as the central hub for Audacy’s digital media distribution. This app streams over 850 live radio stations, exclusive on-demand audio content, and numerous podcasts and music stations.

The way that Audacy generates revenue is quite simple. Using the premium audio content that it produces, Audacy earns revenue primarily by selling advertising across its radio stations, digital platforms, and podcasts. Its broadcast radio segment generates money by selling commercial airtime to local and national businesses that want to reach listeners in specific markets. The more listeners a station has, especially during peak times like morning and evening commutes, the more Audacy can charge for those ads. Its digital media segment makes money through audio ads placed on its streaming app, website, and podcasts. These digital ads can be targeted to specific demographics or listener behaviors, which makes them more valuable to advertisers. Audacy also earns revenue through podcast sponsorships, where brands pay to be featured in or alongside popular podcast content [1].

Circumstances Precipitating Chapter 11 Bankruptcy

COVID Pandemic

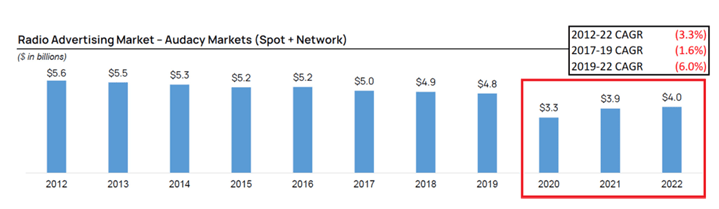

The COVID-19 pandemic had an immediate and severe impact on Audacy’s business, particularly by disrupting radio listening habits and reducing advertising demand. As millions of workers began working from home, weekday commuting patterns, historically a core driver of radio listenership, were drastically curtailed. This change undercut one of Audacy’s most valuable audience segments: morning and evening drive-time listeners. Simultaneously, many of the company’s advertising clients responded to the broader economic uncertainty by slashing marketing budgets, leading to a sharp decline in advertising revenue of 35.4% in 2020 (see Figure 3 below). Even as daily commutes have partially returned, office occupancy rates in major metropolitan areas, where Audacy’s station portfolio is most concentrated, have remained significantly below pre-pandemic levels. This has contributed to a lasting decline in broadcast radio listening and a weaker advertising environment for traditional broadcasters like Audacy [1].

Broad Shift Away From Broadcasting to Digital Media

Beyond the pandemic, Audacy has also faced structural challenges tied to a long-term shift in consumer behavior, from terrestrial broadcasting to digital audio consumption. Over the past decade, audiences have increasingly turned to digital platforms like podcasts, music streaming, and on-demand content, which offer greater personalization and mobility. This shift has redirected both audience attention and advertising dollars away from traditional radio. While Audacy has made substantial investments in digital media, including building a robust podcast portfolio, acquiring streaming and ad-tech platforms like AmperWave and Podcorn, and enhancing its proprietary Audacy App, the monetization of these assets has not kept pace with the revenue decline in its legacy broadcasting segment [1].

Both of the two aforementioned causes have led to a structural decline in the radio broadcast industry. As seen in Figure 2 below from Audacy’s first day declaration filing, the Radio Advertising Market (measured by industry revenue) that Audacy serves have seen a significant decline from pre-pandemic levels, but the overall size of the market has stagnated and has seen slight declines since 2012,- a representation of the increased competition and decreasing customer base stemming from digital media stealing customers [1].

Figure 2: Radio Advertising Market [1]

Thus, companies like Audacy, that held a dominant position in the market, only started to see significant headwinds during the pandemic, but there were signs of struggle in the radio broadcasting industry in the years prior. The pandemic accelerated the shift towards digital media that other competitors had been investing in for the previous decade. This left Audacy and other players in the radio broadcasting space in a precarious situation: should the company make the transition to digital media (which will require capital investment) or continue to operate in a declining market? Ultimately, Audacy made the decision to increase its investment in digital media (hence the creation of the Audacy app and many acquisitions to bolster its digital media platform).

In 2021, the company reported a substantial increase in its capital expenditures relative to the year prior (see Figure 3), indicating that the pandemic in 2020 caused a re-evaluation of strategic operations and a desire to shift more towards digital advertising. Despite these changes, however, the company reported weak financials, with revenues still remaining below pre-pandemic levels [1].

Figure 3: Audacy Financials Pre-Bankruptcy [3],[4],[5]

The financials in Figure 3 above add clarity to the two aforementioned causes of bankruptcy discussed above. While Auduacy’s advertising / broadcast revenue segment remained strong in 2018 and 2019 (boosted from their CBS acquisition in 2017), revenues dropped over 35% with the consent of the pandemic. Audacy saw some resurgence in 2021 as the effects of the pandemic started to dissipate towards the end of the year / there was increased travel back to work, but these levels still remained depressed from pre-pandemic levels.

During this time, Audacy’s Digital Revenue began to grow (supported by significant capital expenditure investments) - but these revenues still only represented ~20% of Audacy’s total revenues in 2023, indicating that the company has not been able to capitalize on consumer shifts towards digital content.

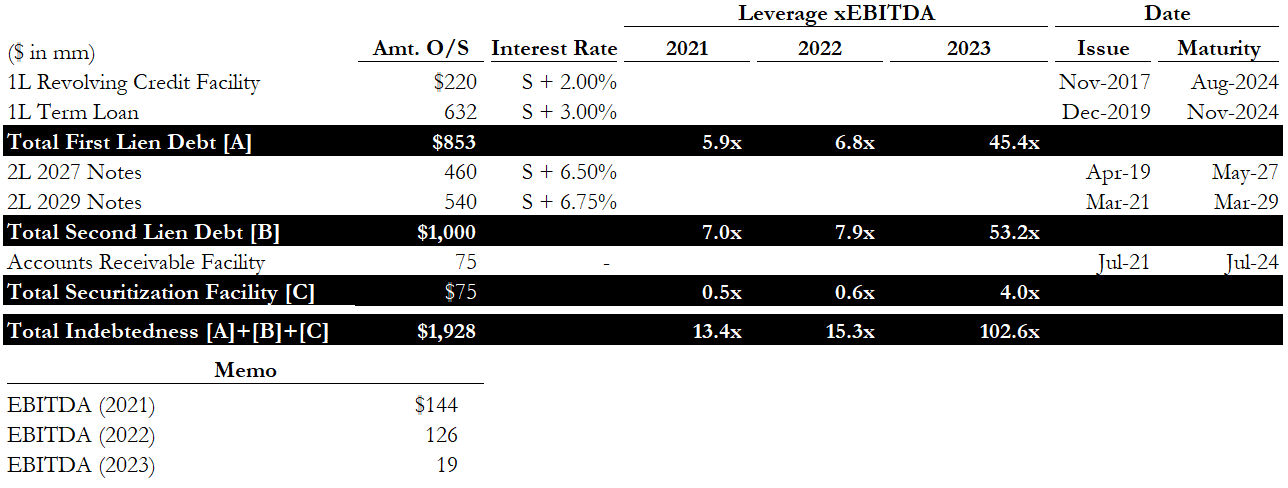

Pressure from Indebtedness

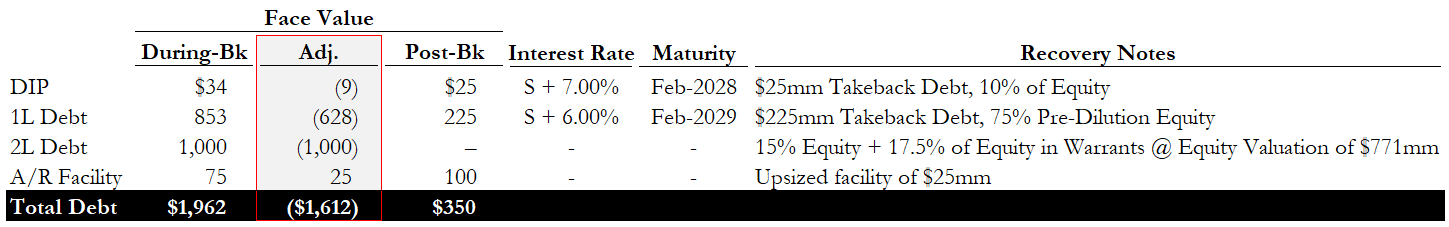

Finally, Audacy was facing significant pressure from its capital structure (see Figure 4 below). The company’s long-term debt consisted of a first lien credit facility, second lien debt, and an accounts receivable facility [1],[2]. The terms of these facilities can be seen below.

Figure 4: Pre-petition Capital Structure [1]

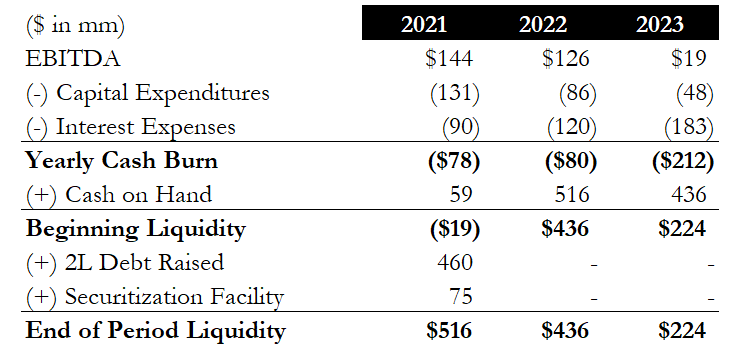

From 2021 to 2023, the combination of the three causes discussed above put significant pressure on Audacy’s operations. As seen in Figure 5 below, Audacy was experiencing negative cash flows from 2021 to 2023 (with cash burn being over $200mm in 2023). Without any capital infusions, the company would have had a negative liquidity balance in 2021 (meaning they would be unable to pay their interest expenses and debt obligations and would likely have to restructure immediately). However, the company was able to raise the 2L notes due 2029 of $540mm plus $75mm in the A/R Facility (see Figure 4 above) in 2021, which provided over $600mm in capital that allowed the company to operate through 2023 without running out of liquidity. However, with yearly cash burn extending over $200mm in 2023 and interest rates expected to stay elevated through 2024, it became clear to Audacy that it would run out of liquidity in 2024 without any additional capital infusions.

Figure 5: Audacy Yearly Liquidity Balance

During 2021 to 2023 (following the capital raise), no material changes were made to the company’s capital structure as a result of the deteriorating industry dynamics and elevated interest rate environment, leading the company to explore a more expansive debt restructuring process by 2023. It is worth taking a moment to note what the cause of this deteriorating financial performance was. While we discussed COVID above as a leading cause Audacy cited for its worsening performance, the COVID pandemic can only be attributed to the fall-off in performance in 2020-2021. The main cause for Audacy’s performance was thus the second cause we discussed - digital advertising growth and Audacy’s outdated business model. The above financials paint the story that the company was a dominant player when traditional broadcasting was still booming, but as soon as the broadcasting industry faced industry headwinds, Audacy’s financial performance declined rapidly, indicating an outdated business model that required a substantial revamp. So, from 2022 to 2023, Audacy was facing two problems: an overleveraged capital structure that put burdensome cash requirements on the company, as well as the need to update its business model (which also required significant cash investments).

By June 2023, Audacy entered into active negotiations with its two major creditor groups, holders of its First Lien Credit Facility and Second Lien Secured Notes, in an effort to restructure its highly levered balance sheet.

Over the following months, the company and its advisors exchanged restructuring proposals with both creditor groups, though consensus proved difficult due to disagreements over collateral valuation and how reorganized equity should be allocated. By this time, Audacy was facing a liquidity crunch with nearly $51 million in interest payments coming due in the fall of 2023. Although the company had enough liquidity to cover these interest payments, it would have left them in a weak position come 2024, as nearly all of their free cash flow would be going towards these interest payments. To conserve cash, it entered multiple grace periods on both first and second lien interest obligations between September and December. These deferrals helped avoid immediate default while negotiations continued. Ultimately, in December 2023, Audacy reached a deal with both creditor groups and signed a Restructuring Support Agreement that paved the way for a prepackaged Chapter 11 filing in January 2024 [1],[2].

Bankruptcy Process

As previously stated, when Audacy filed for bankruptcy, it had a completed Restructuring Support Agreement (RSA) with the requisite support for its creditor constituents. The first component of this RSA that we will discuss is the DIP financing. Certain members of the pre-petition first lien group made up the 1L Ad Hoc Group, which agreed to backstop a $32mm new-money debtor in possession financing. Interestingly, this DIP facility did not feature any roll-up amount. However, to provide adequate compensation to these lenders for providing new capital to the debtor, these lenders received 2% of the total DIP facility in a commitment fee as well as 3% of the total DIP facility as a backstop fee (totally representing 5%*32mm = $1.6mm). These fees can often act as a significant source of recoveries for DIP lenders as they provide compensation for the ‘acts’ taken by the DIP lender. Commitment fees are provided to DIP lenders for the act of providing capital, and backstop fees are provided to the DIP lender if they guarantee to provide a certain amount of the DIP facility, and cover the rest of the DIP financing needed if alternate lenders cannot be found. Another common fee is an exit fee (not seen in Audacy), which gives compensation for the completion of the DIP loan when it is repaid. These fees will be paid out on different dates that are agreed upon between the lender and the debtor. The DIP facility featured an interest rate of SOFR + 600 bps [2].

The other component of this restructuring was what the post-bankruptcy capital structure would look like, and who would own the new debt and equity of Audacy. To explain this, we will first look at the DIP lender’s recoveries. As a part of the restructuring support agreement, the DIP lenders who provided the $32mm converted their DIP loans into a $25mm first-out facility (featuring an interest rate of SOFR + 700 bps). Because this conversion does represent a loss of $7mm (ignoring the effects of interest expenses and fees), DIP lenders were also provided their pro-rata share of 10% of the post-bankruptcy equity in Audacy [2]

The next point of discussion is for the pre-petition first lien debt (which, as a reminder, amounted to $853mm). For the 1L lenders (which includes both the ad hoc group that provided the DIP financing as well as the non-ad hoc group that did not provide the DIP), their recovery was split into new take-back debt as well as the majority of the reorganized equity. Specifically, the 1L lenders received their pro rata share of $225mm of take-back debt (featuring an interest rate of SOFR + 600 bps) as well as 75% of the equity (which is subject to dilution) [2].

The pre-petition 2L notes (which amounted to $1bn pre-petition) saw their claims completely equitized. Specifically, the 2L noteholders received a pro-rata allocation of 15% of the pre-dilution equity and warrants that were exercisable within 4 years for 17.5% of the equity of the reorganized Audacy, at an equity valuation of $771mm (i.e, if the value of Audacy reaches or exceeds $771mm within 4 years after the company exited bankruptcy, 2L lenders could obtain their pro rata share of an additional 17.5% of the equity). This 17.5% of equity that 2L could get would dilute the equity stake that the DIP lenders and 1L lenders hold at the time the company exits bankruptcy (i.e, the 17.5% would dilute the stake held at the time of bankruptcy by the DIP and 1L lenders, not the stake at the time the warrant is exercised). [2].

Finally, the A/R facility remained largely unchanged, with the only difference being the total size of the facility was upsized from $75mm to $100mm. A summary of the changes to the capital structure and equity structure can be seen in the image below.

Figure 6: Post-Bankruptcy Capital Structure [2]

With the plan structure outlined, there are two points that are worth diving into further.

The first revolves around the DIP facility. Generally, it has been historically rare to see DIP facilities have their claims receive recovery in the form of equity. The reason for this is that recoveries associated with equity are subject to volatility, especially for a distressed / bankrupt company. The future equity value will be completely dependent on whether or not the bankruptcy process was successful and if the company can successfully fix its operations to create value for its creditors and shareholders. Thus, secured creditors (which care more about a fixed return with low volatility) often prefer either cash or take-back debt as a form of recovery rather than equity.

As a reminder, for any piece of secured debt, a recovery in the form of anything coming outside of the claims that specifically secure their assets (i.e, recovery in the form of equity) means that that secured creditor class is impaired, even if they receive 100% of the reorganized equity. So in this case, with DIP lenders receiving 10% of the reorganized company, these creditors were impaired. Remember, the case of Audacy represents a prepackaged bankruptcy where negotiations were conducted well in advance of the actual filing date, so the DIP lenders at this point were well aware of the value of the company. As a result, they knew what the estimated value of the company was and what forms of recovery they would receive. The DIP facility did not represent a substantial amount of debt relative to the pre-petition amount of $1.9bn, so the DIP lenders could arguably have negotiated a recovery that either comes from take-back or debt

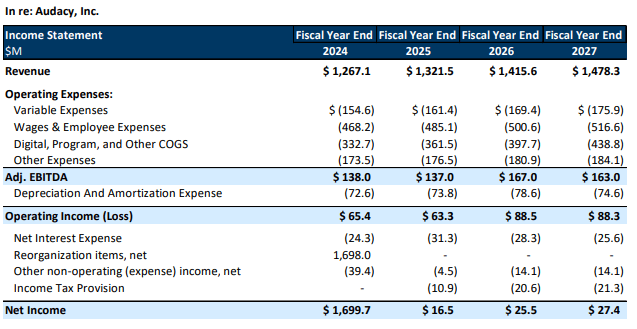

Thus, the question becomes: in what circumstances would lenders want equity as a form of recovery? Based on our discussion of the volatility associated with reorganized equity, the answer should be somewhat apparent. A secured creditor will prefer equity recovery when they believe the value of the company can be salvaged. One advantage of getting equity in a post-bankruptcy company is that you receive the equity at likely all-time valuation lows, so the ‘value creation’ needed to be done by the company to achieve a return for shareholders is not going to be as large as the value creation needed for a healthy company. In the case of Audacy, the DIP lenders (who were also the 1L lenders, which had their claims largely equitized) must have believed that the company would successfully be able to turn around its operations. As a note, the DIP loan was provided by Laurel Tree Opportunities Corp, an investment arm of Soros Fund Management. The thesis that the company could turn its operations around is supported by the valuation analysis done by the debtors' advisors, PJT (see the figure below), where the company estimated that its revenues would recover to pre-pandemic levels by 2026 (we will discuss this valuation shortly).

Figure 7: Financial Estimates [2]

The second point of discussion worth mentioning is the inherent valuation fight that likely existed between the 2L noteholders and the 1L/DIP creditors. As a general rule of principle, creditors that sit higher in the capital structure prefer a lower valuation. There are a couple of reasons for this. First, a low valuation is going to be subject to less scrutiny from a judge (remember, a plan and plan valuation have to estimate the true value of the company). With less scrutiny, the plan is more likely to get approved quickly, which can help preserve value within the company.

Another reason that creditors who sit at the top of the capital structure prefer a low valuation is that, in circumstances like Audacy, where these creditors are receiving equity as a form of recovery, a low valuation will allow these creditors to obtain the majority of the post-reorganized equity. While creditors at the top of the capital structure prefer a low valuation, creditors at the bottom prefer a high valuation. The reason for this should be intuitive: these creditors are likely to be the fulcrum and are likely to be severely impaired in bankruptcy, so any extra valuation will only boost their recovery. This disconnect between creditor groups creates valuation fights in bankruptcy cases, where multiple constituents may argue for different valuations of the company. This can often lead to a lengthy litigation process that can extend bankruptcy for months on end.

In the months of negotiation prior to Audacy’s bankruptcy filing, this valuation fight between the 2L creditors and the DIP/1L creditors undoubtedly arose. To solve this issue in advance, the company used a tool that is commonly seen in bankruptcy cases where valuation fights are likely to occur: warrants. As a brief overview, warrants are financial instruments that give the holder the right, but not the obligation, to purchase a company’s stock at a specific price (the “exercise price”) within a certain time frame. In the case of Audacy, the company provided the 2L lenders with warrants that would become exercisable when the equity valuation of the company reached $771mm. The reason these warrants solve the valuation fight in a capital structure is that it forces creditors who want a higher valuation to ‘put their money where their mouth is’. This is because, if a creditor truly believes the valuation is higher, they should inherently prefer a warrant that provides value if that valuation is actually achieved. If the creditors at the top of the capital structure offer warrants (that would dilute their own claims if the value is achieved), a judge is thus inclined to favor these creditors' arguments.

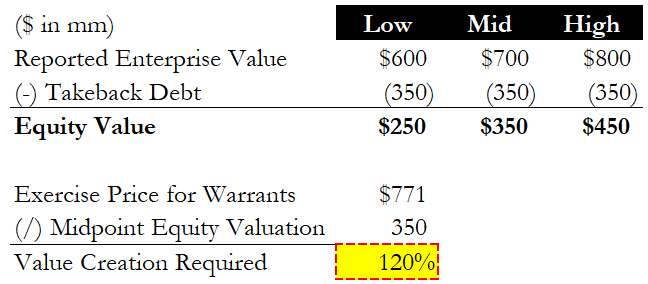

For Audacy, the company projected a present enterprise value range of $600mm to $800mm, with a midpoint valuation of $700mm (determined based on the financial performance of the company as seen in Figure 7). Given that Audacy is projected to generate $138mm of Adjusted EBITDA in 2024, the valuation range represents an EV/EBITDA multiple ranging from 4.3x to 5.8x. In 2018/2019 (the last years of healthy financials for Audacy), the company was trading at an EV/EBITDA multiple of 9.0 to 10.0x, meaning that the post-reorganization valuation reflects a business valued about half of what it was previously. With $350mm in total take-back debt, the equity valuation ranges from $250mm to $450mm. Assuming a midpoint equity valuation of $350mm, this means that the 2L creditors need the company to increase its valuation by 120% within 4 years such that they can exercise their warrants to increase their stake in the company. This analysis can be seen in the Figure below [2].

As an important aside, we want to note the feasibility of this valuation being achieved. While in-depth valuation disclosures were not provided in the bankruptcy dockets, we can assume that the financial estimates in Figure 8 above will lead to the midpoint equity valuation of $350mm. If we just look at revenue relative to Audacy’s 2018/2019 levels, the debtor’s advisors projected the company’s revenue to return to pre-pandemic levels by 2027. For clarity, if these revenues are achieved, the debtors estimate their equity value will be around $350mm (midpoint valuation). Given that this change will require either 1) a significant recovery in the broadcasting industry or 2) Audacy to capture a significant portion of the digital advertising space. Therefore, there appears to be a significant barrier that Audacy faces in order to exercise its warrants. This is because, to achieve an equity valuation of over $700mm, the company will need its revenues to grow beyond what they were prior to bankruptcy (or effectively grow its valuation to over 9x EV/EBITDA as that is what it was valued prior to bankruptcy), which will be a difficult task as they do not hold a strong position in the digital advertising space relative to their radio broadcasting segment. Thus, this indicates a low probability that the 2L lenders will be able to exercise these warrants within 4 years.

Figure 8: Warrant Valuation Analysis [2]

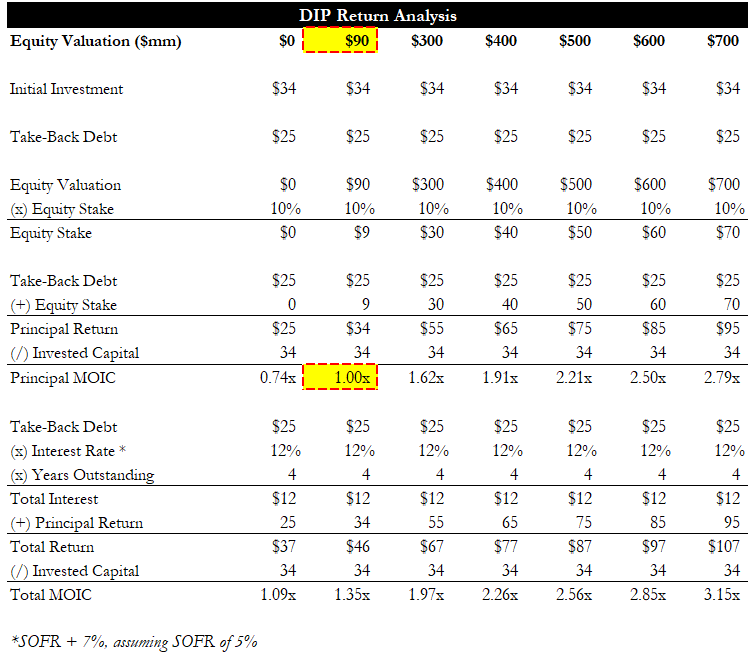

To help add clarity to the returns for each tranche of investors, we have provided analysis in the Figure below on what each return for each creditor class will be, assuming different valuations of the company.

Let’s first look at the DIP lenders. As discussed earlier, these lenders provided $34mm in new money, and are receiving $25mm in take-back debt (which features an interest rate of SOFR + 7%, as well as 10% of the post-reorganized equity. In the image below, we have provided two return analyses: one that just looks at the principal recovery, and another that looks at total recovery (which includes the interest income from the take-back debt). We look at recoveries where the principal and total return are affected by the equity valuation, which ranges from $300mm to $700mm. In each of these scenarios, the company generates a total multiple of invested capital that is close to or exceeding 2x their initial investment of $34mm. Thus, it is very clear that the returns on the DIP loan are incredibly attractive in this case. This is further supported by the valuation at the bottom, where, to achieve a total MOIC of 1.00x on their $34mm of invested capital, the company needs to have an equity valuation of just $90mm, meaning it can underperform its financial estimates seen in Figure 7 (and even have an EV/EBITDA multiple lower than the predicted range of 4.3x to 5.8x) and still recoup their principal investment.

Figure 9: DIP Lender Returns

Next, we can look at the First Lien lenders. The 1L lenders provided $853mm of capital at the time of bankruptcy, and their recovery came in the form of $225mm in take-back debt (featuring an interest rate of SOFR + 6%) as well as 75% of the post-reorganized equity. Before we look at the numbers, it is clear that a significant portion of the return will come from the equity for the 1L lenders, given that they own 75% of the company, meaning that it is likely they will require a substantial increase in valuation to see a positive return. This is justified when we look at the analysis done below, which mimics that of which we did for the DIP lenders. With an equity valuation range of $300mm to $700mm, the 1L lender's total MOIC ranges from 0.64x to 1.00x (shown in the image below). As we discussed, reaching an equity valuation exceeding $700mm will be difficult as it requires the company to turn around its operations such that its financials are stronger than they were prior to the pandemic. While this may seem difficult, it should not come as overly striking, however. Given that the DIP and 1L lenders received part of their recovery in the form of equity, it is clear that the value of the company did not exceed the amount of 1L debt held prior to filing for Chapter 11 bankruptcy. Given that the DIP and 1L lenders acted as the fulcrum security, it thus makes sense that they will not receive a return of par immediately, and will need a substantial business turnaround to see a positive investment.

Figure 10: 1L Lender Return Analysis

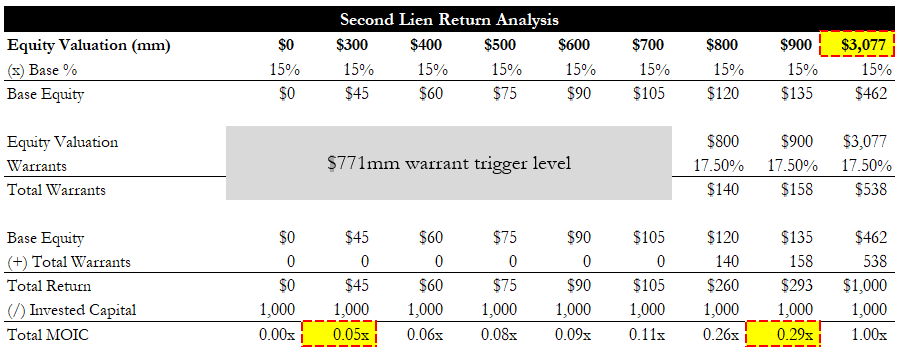

Finally, we can look at the 2L debt. Given that the 1L debt only breaks even on its return at a valuation of ~$700mm, we can expect 2L holders to be materially impaired. This can be seen in the image below, where, from an equity valuation range of $300mm to $900mm, the total MOIC ranges from 0.05x to 0.29x. Remember, the 2L holders did not receive any take-back debt as part of the restructuring, so their recovery solely comes from an equity turnaround. Additionally, the reason the total MOIC increases substantially from the $700mm to $800mm valuation range is because of the warrant being exercised, where the 2L holders obtain an additional 17.5% stake in the company (increasing their total stake to 32.5%). Despite the exercisable warrants, however, the 2L lenders would still need an equity valuation exceeding $3bn to break even on the $1bn of capital lent prior to chapter 11, making it almost impossible for these lenders to return a positive investment.

Figure 11: 2L Lender Return Analysis

With the RSA being completed prior to the bankruptcy filing and creditor consent already being obtained, Audacy’s prepackaged bankruptcy was approved by February 20, 2024 (lasted just under two months). During this bankruptcy process, Audacy was delisted from the New York Stock Exchange, and as such, no information is available on the company’s recent performance. However, it was reported in late 2024 that the company was looking to have its current shareholders (i.e, the DIP, 1L, and 2L lenders) engage in a private stock sale, where shareholders would purchase 5mm shares at a price of $20 per share, which would raise $100mm for the company. However, in January 2025, Audacy reported that it did not have enough shareholder support to go through with this transaction. While we can only speculate, this likely indicates that the shareholders are unwilling to provide new capital / do not want to further commit to this business without seeing some sign of a turnaround first.

From here on out, every creditor’s returns will hinge on the turnaround of this business, and time will tell whether or not Audacy can compete in the increasingly competitive digital media space as well as obtain more value from the dominant radio broadcasting segment. Regardless, this bankruptcy case represents a classic example of a valuation fight with the added complication of the fact that nearly every constituent in the capital structure sought to maximize their return in the form of equity.